Treasury Onboarding

Where Fragmentation Is Most Visible. And Most Fixable.

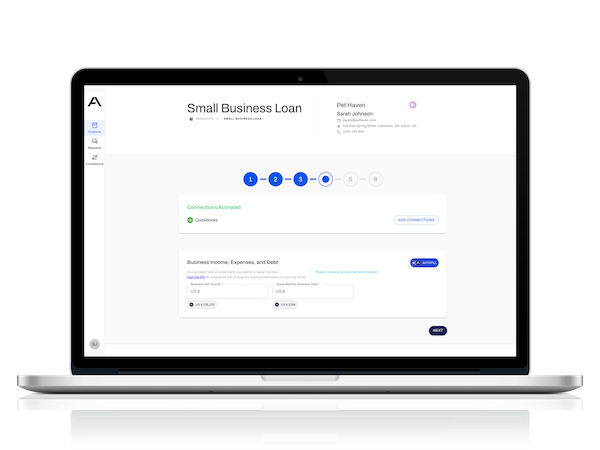

Start your Ascent journey here

Treasury onboarding is one of the most operationally complex and least forgiving experiences in business banking. It touches multiple systems, requires multiple approvals, and depends on precise configuration. When it goes wrong, businesses feel it immediately.

It is also one of the clearest places to modernize how work gets done.

Ascent delivers a structured, connected treasury onboarding experience that removes friction for businesses and reduces operational burden for your teams, while establishing shared data that supports ongoing servicing and growth.

Treasury onboarding is rarely a single event. It often follows account opening, lending, or a servicing change. New products are added. Limits are adjusted. Cards, ACH, wires, and entitlements need to be configured correctly and in sequence. In most institutions, this work is spread across emails, forms, spreadsheets, and ticket queues.

Ascent brings this work into one coordinated flow.

Using Ascent, institutions configure treasury onboarding workflows based on their own policies, products, and approval structures. Tasks are routed automatically to the right teams. Required data and documents are collected once and reused across steps. Progress is visible, tracked, and auditable from start to finish.

Treasury onboarding becomes collaborative rather than opaque. Business customers know what is required and where things stand. Internal teams work from the same shared context instead of passing partial information between systems. Errors caused by re-keying, missed handoffs, or outdated forms are dramatically reduced.

Ascent also makes it easy to start here.

Treasury onboarding does not require a full rip-and-replace or heavy upfront integration. Institutions can begin with limited data inputs and existing systems, bringing structure and visibility to a process that is often manual and fragmented. Value appears quickly, even before additional workflows or systems are connected.

Many tools can support individual treasury tasks. The problem is coordinating them into a complete, reliable experience.

For many institutions, treasury onboarding is an ideal place to start with Ascent. It delivers immediate operational relief, improves the business customer experience, and establishes unified data that can later support servicing, reviews, renewals, and deeper relationship management.

Why this works as a starting point

Treasury onboarding exposes fragmentation more clearly than almost any other workflow. Fixing it creates immediate operational relief and shared data across teams.