Members Preferred Credit Union: The Right Choice and the Right Time

Jun 18, 2025

Idaho Falls, ID

Financial Services - Credit Unions

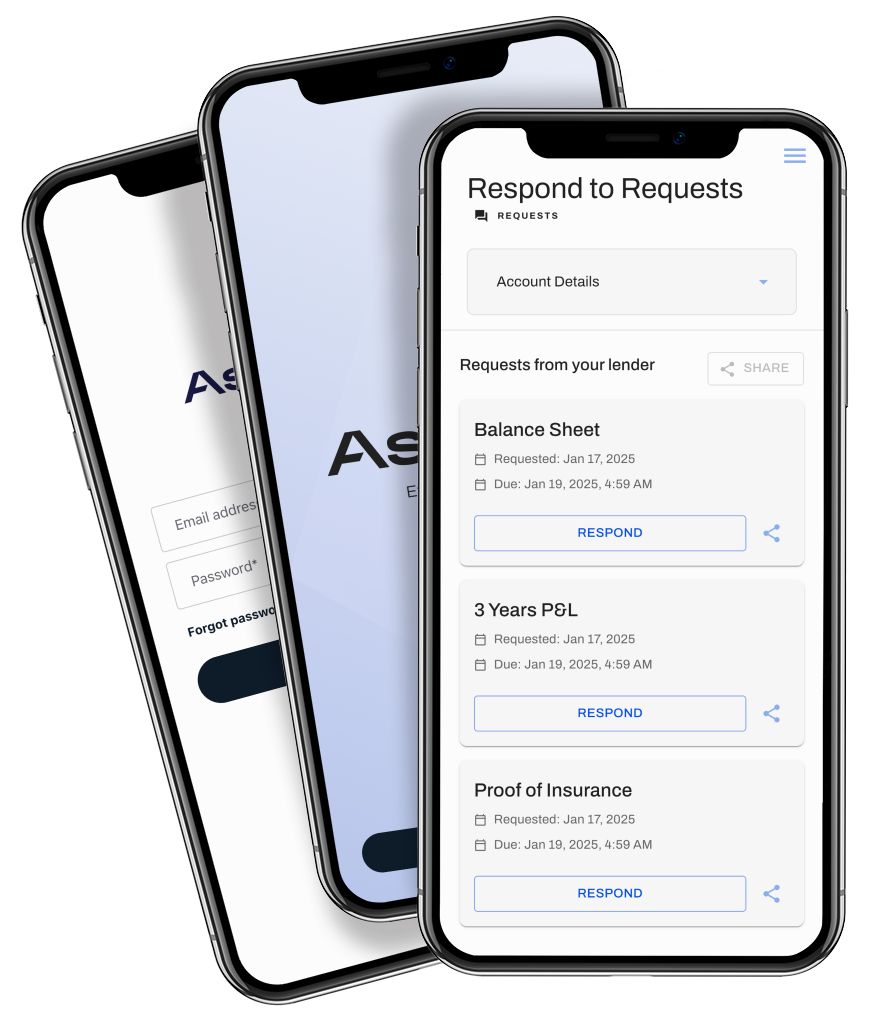

Ascent Consumer Suite Lending Module

Background

Members Preferred Credit Union is a small, community-focused institution distinguished by its commitment to personal service and one-on-one relationships with its members. Unlike many of its larger peers that have expanded or merged to stay competitive, Members Preferred has retained its single-branch model, using its size to provide familiarity and trust to local members.

Josh Johnson, the VP of Lending, oversees all loan-related operations including online applications, making him directly responsible for implementing digital solutions that improve member access and internal workflows.

Members Preferred had been using TruStage's LoanLiner.com system for online consumer loan applications. However, the announcement of LoanLiner.com's impending sunset forced the team to search for an alternative quickly.

And while LoanLiner.com functioned adequately, it had one key limitation: difficulty downloading member-submitted documents (like IDs and pay stubs) in a usable format. This sometimes required redundant requests to members, slightly hindering the efficiency of the lending team.

An Easy Decision

Josh received outreach from multiple vendors once the sunsetting of LoanLiner.com was announced. From the start though, Ascent stood out for its clear communication and professional presentation.

The email from Ascent was more direct and to the point... that piqued my interest.

Josh Johnson, Vice President of Lending at Members Preferred Credit Union

Ascent's Consumer Suite is a flexible solution that can be used to provide members with an exceptional experience for any online application or form. It is editable, auditable, and white-labelled with the credit union's branding and colors. During a smooth demo experience, the Member's Preferred team found that Ascent closely mirrored what they were already using but with a more modern look and feel - which was key to avoiding retraining staff or disrupting workflows. They chose to move forward with Ascent, not just due to Ascent's visible professionalism, but also its commitment to making the transition from Loanliner.com as seamless as possible.

A Seamless Implementation Experience

Ascent worked closely with TruStage to tailor a solution for existing LoanLiner.com credit unions. This included developing a conversion utility that enables Ascent to recreate the credit union's existing loan applications on the Ascent platform in just minutes! This makes the onboarding process seamless and efficient. The credit union's effort consisted of providing their branding elements and then reviewing their applications to ensure everything worked as expected. This took approximately three weeks from start to finish, including time spent on internal testing.

It was pretty easy. The team was very clear on what I needed to do… we just did some testing and went live.

Josh Johnson, Vice President of Lending at Members Preferred Credit Union

The biggest improvement request - reordering application types to suit the credit union's focus on certain credit products - was acknowledged and rapidly addressed, reflecting Ascent's responsiveness. Using Ascent's no-code Product Builder, the Ascent team was able to reconfigure the application in a handful of days.

Additionally, Ascent collaborated with TruStage to integrate TruStage's consumer protection and insurance products into the experience. Applicants can review offered products and pricing, and indicate interest to the credit union as part of the online loan application.

“We view every interaction with the credit union and their members as part of the whole product experience–not just the platform itself, but how we engage with them during their evaluation process, the implementation, and how we work with them after initial deployment,” according to Senior Solutions Engineer John Byrne. “Everything is an opportunity to reduce friction for members and associates, and increase efficiency for the institution.”

Stakeholder Impact

On Members

The transition was designed to be invisible to members - and it was.

No news is good news. We haven't had any complaints or issues reported. People are applying, and the system is working.

Josh Johnson, Vice President of Lending at Members Preferred Credit Union

Josh noted that while online loan applications make up only a portion of their total volume, maintaining that channel is essential.

On Internal Operations

The internal workflow remained unchanged, which was the goal.

What Ascent had is what I needed. I didn't want to waste time - just needed something simple and similar.

Josh Johnson, Vice President of Lending at Members Preferred Credit Union

Ascent regularly gathers feedback from credit union clients including Members Preferred, and works to continually deploy improvements to the SaaS platform as they become available.

Results

Since implementing Ascent's Consumer Suite, application volume and completion rates have remained consistent. While online applications only represent a small portion of the credit union's total lending activity - the majority comes directly from dealer relationships - Josh emphasized that even a handful of applications per week is meaningful. Losing those opportunities due to a lack of online functionality would have been a setback, so maintaining a reliable platform was essential.

The smooth transition preserved the member experience and ensured staff could continue their work without disruption. The entire implementation process was quick and problem-free, a rare feat in software rollouts. Josh noted that what impressed him most was the absence of complications; the team was able to move forward without encountering any technical roadblocks.

What surprised me most? That there weren't any surprises. No hiccups. No delays. It was just smooth.

Josh Johnson, Vice President of Lending at Members Preferred Credit Union

Conclusions

For Members Preferred Credit Union, Ascent proved to be the right choice at the right time. It replaced a legacy system without introducing new friction, maintained continuity for members, and aligned perfectly with the institution's need for simplicity and reliability. Ascent's professionalism, speed, and user-first design ensured a successful transition - and a lasting partnership.

June 18, 2025

Download as pdf