For decades, vendors have created data silos.

That's how banking software evolved.

It's 2026, and that's over.

Knowing the Full Picture

Changes Everything

Ascent unifies data across all your systems.

A single, living and understood picture of every customer or member.

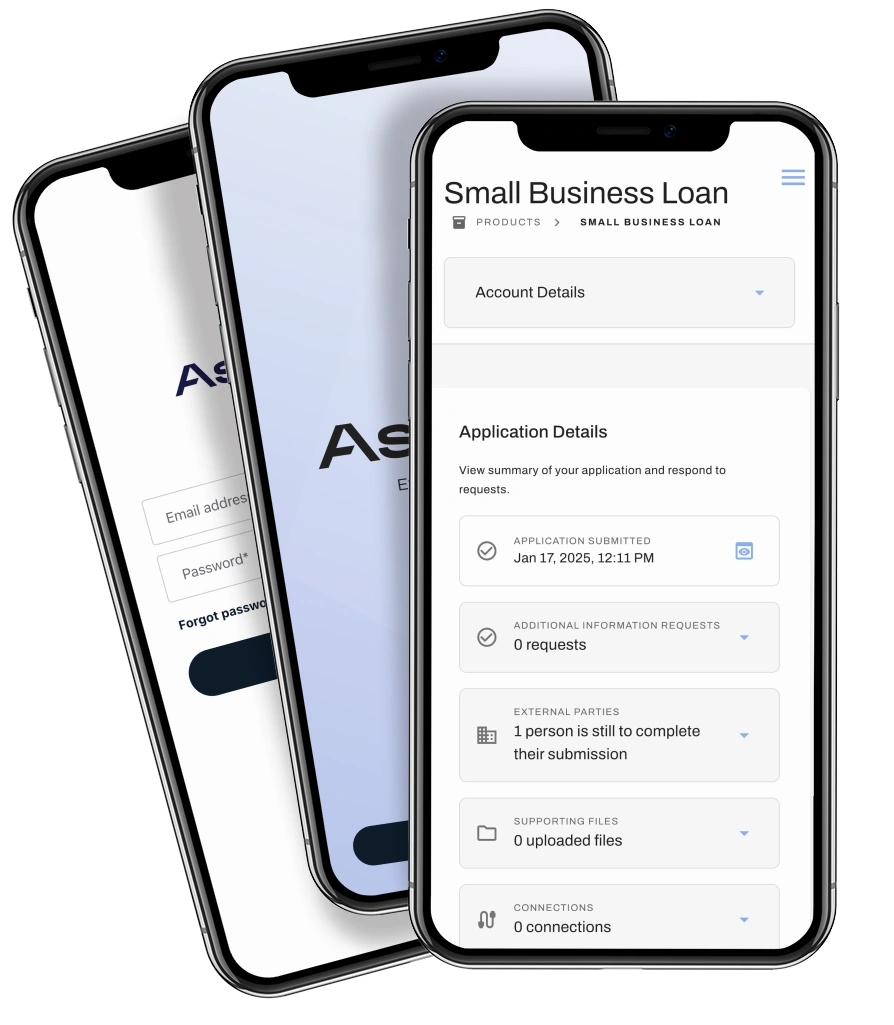

Your execution layer for onboarding, lending, servicing, and AI.

What's Inside Ascent?

Data

A Living Asset.

Building Continuously.

Ascent turns applications, documents, and decisions into connected knowledge. No re-entry. No rework. Just a fuller 360 picture, growing over time.

Insights

Meaningful Signals.

What Matters Now.

Ascent continuously looks for signals. Gaps, changes, and emerging needs are surfaced in context, helping teams focus on the right work at the right time.

Actions

Work in Motion.

End-to-End.

Ascent's intelligence prepares and moves work forward automatically, handling validation, routing and coordination while teams stay in control.

AI Needs Unified Data

Ascent removes the fragmentation.

AI finally has something to work with.

Ascent Conducts the Work

Ascent powers your processes using the data already inside your institution.

Where workflows run.

Where decisions live.

Stop chasing paperwork.

Stop re-entering data.

Ascent is Built For Everything That Follows.

Start with a unified view in one area of the business.

Let workflows attach naturally as value becomes obvious.

Expand at your own pace, without disruption.

Explore a few common starting points.

Each one becomes a foundation for what comes next.

What changes when insight actually drives action

fewer repeated requests for information

Information is captured once and reused across workflows.

reduction in internal handoff delays

Teams move forward with shared, real-time clarity.

faster decisions across complex applications

Connected workflows reduce the time needed to assess and verify.

faster customer completion times

Customers always know what's needed and what comes next.

Ascent is well positioned to sit on top of the systems we have, automate many of our manual processes, and augment the member experience.

Latest From Ascent

Feb 12, 2026

32 min listen

Innovation and Trust: Navigating Tech in Credit Unions

Guest: Jamie Kruspel, Chief Transformation Officer, Mainstreet Credit Union

Sep 02, 2025

3 min read

Case Study: How a Northeast Community Bank Doubled Business Account Openings with Ascent

When it came to digital account opening and treasury onboarding, a $800 million-asset bank in the Northeast found itself limited by outdated technology and paper-heavy workflows...

Jul 08, 2025

Press Release

TruStage™, Ascent partner to streamline financial protection process

TruStage™ and Ascent announces a stronger partnership to bring consumers greater access to financial protection...