Platform Overview

Ascent is the execution layer for modern financial institutions.

Why Ascent is Different

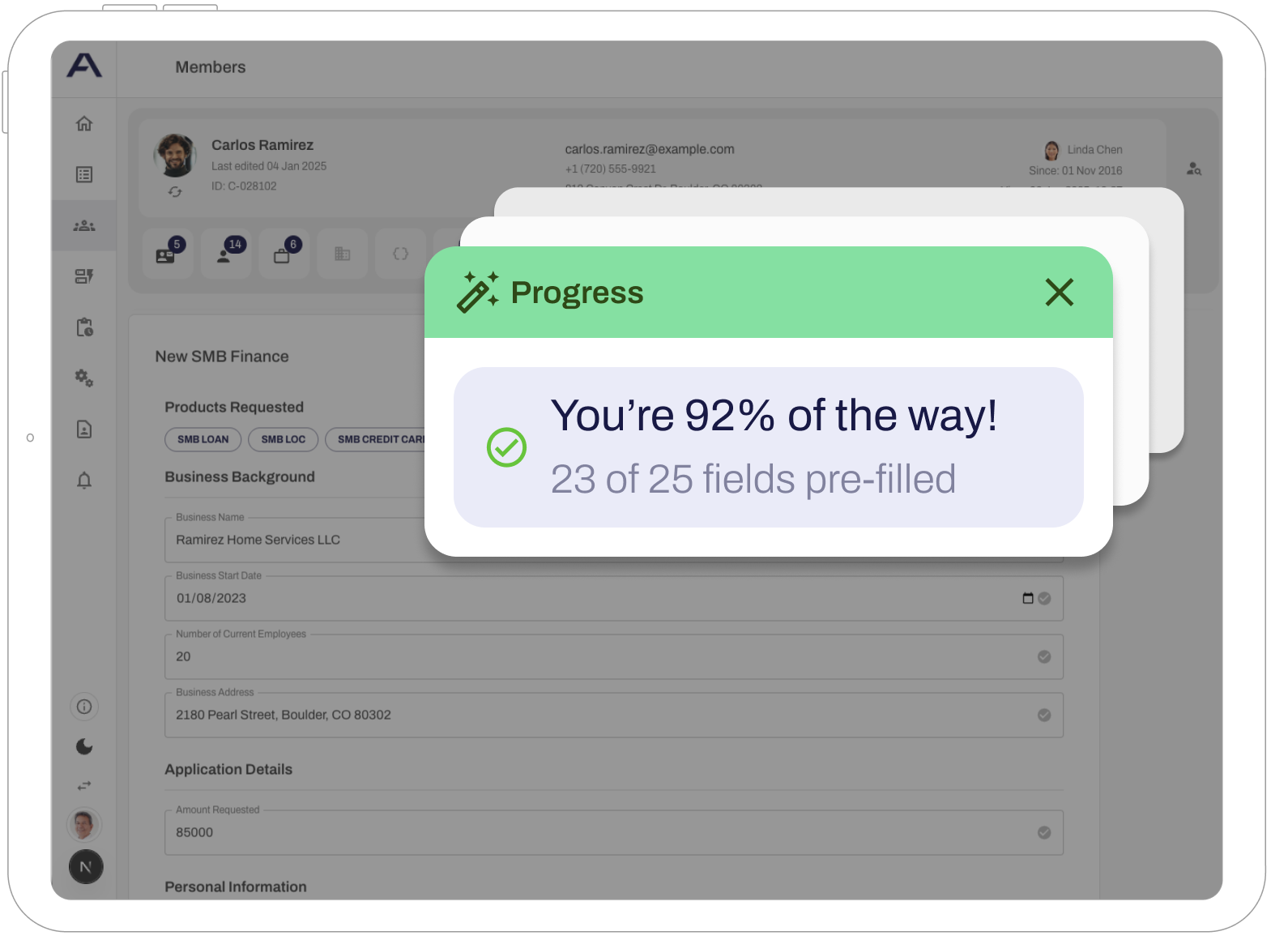

Most banking platforms optimize individual processes. Ascent connects them.

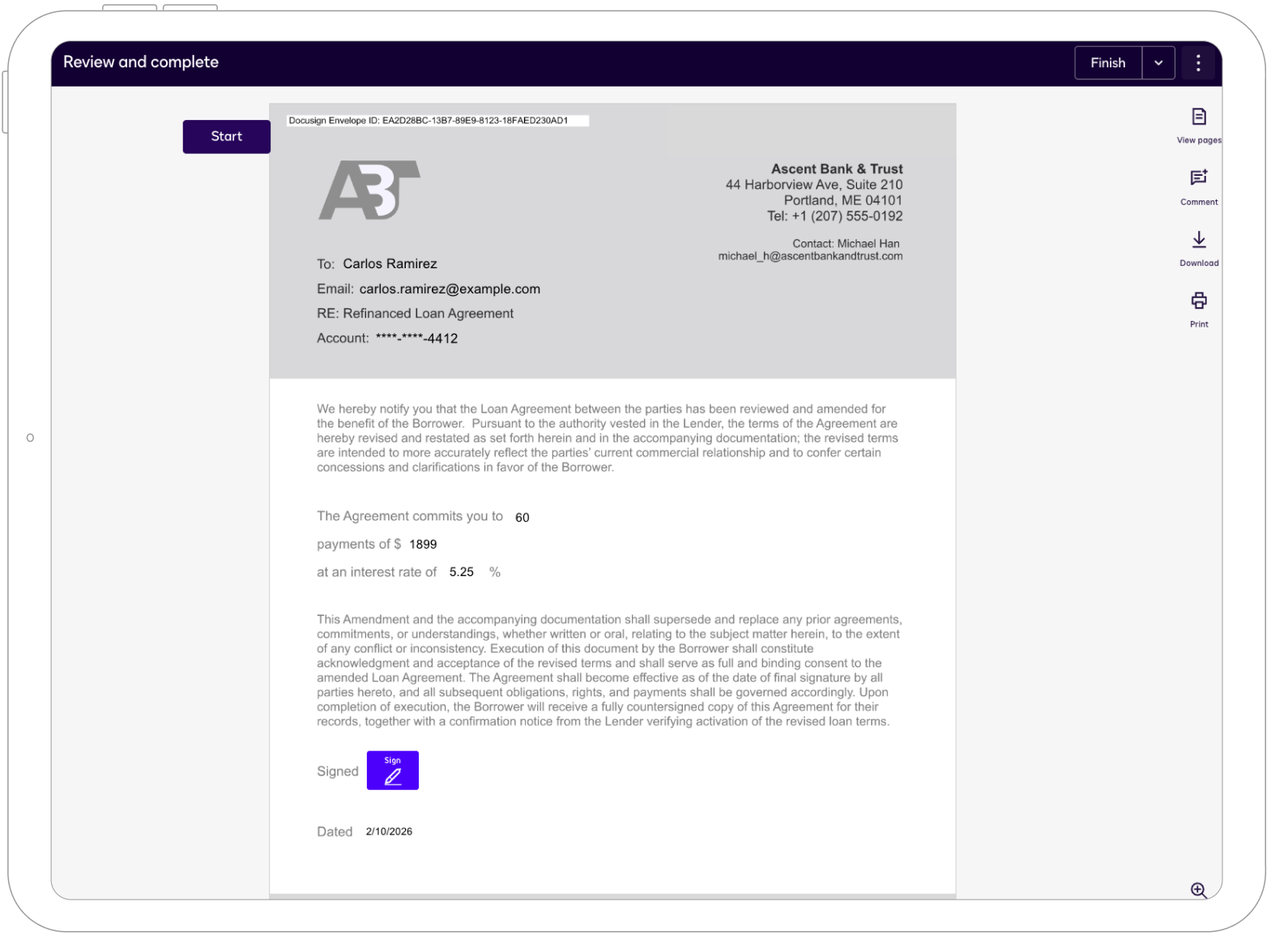

Instead of creating another silo, Ascent brings together data that already exists across your institution and keeps it connected over time. Information is captured once, trusted everywhere, and reused across onboarding, lending, servicing, compliance, and growth.

The result is not just better visibility, but better execution. Work moves forward without re-keying, handoffs, or guesswork.

Insight isn't the end. Execution is.

Where Institutions Start

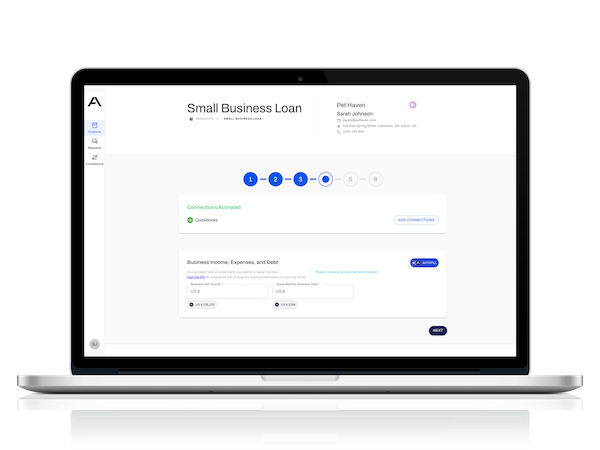

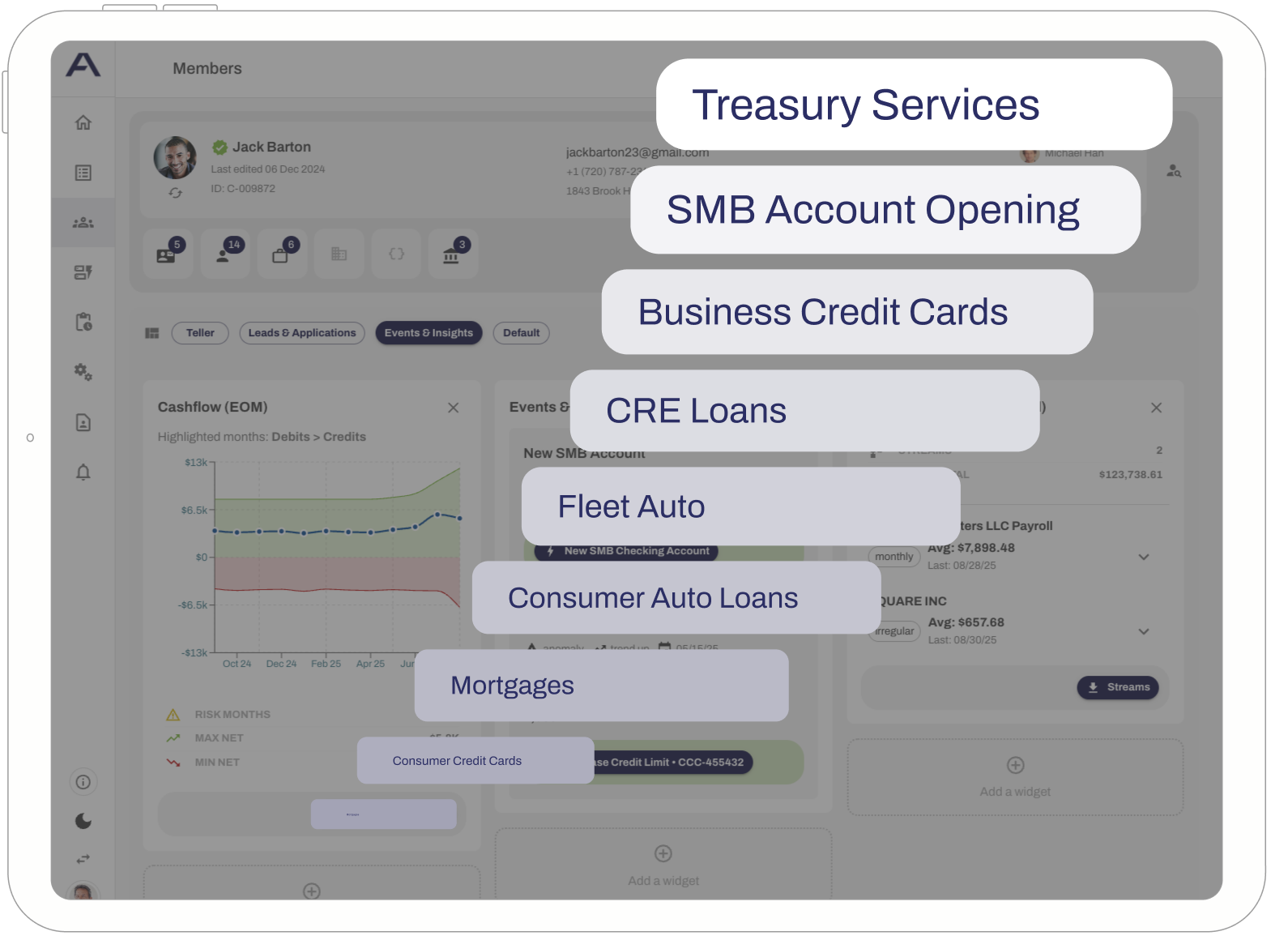

Institutions do not deploy Ascent all at once. They start where friction exists.

Each starting point creates immediate value and establishes shared data that can be reused as the platform expands.

Teams see progress quickly without needing to redesign everything upfront.

Explore a few common starting points.

Each one becomes a foundation for what comes next.

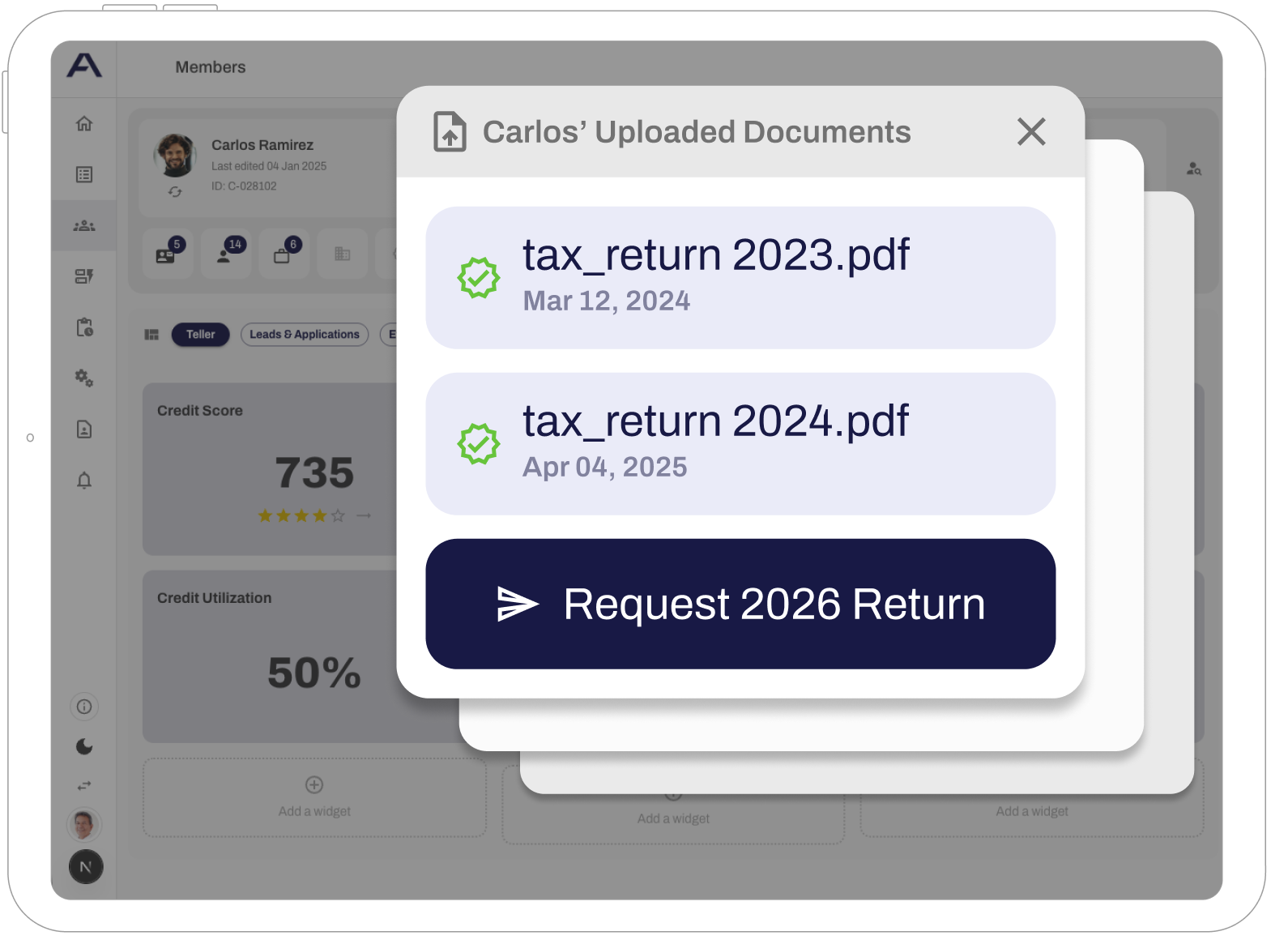

How the Platform Grows

Data collected in one process becomes available everywhere else. The same shared context supports new workflows, new products, and new automation without rebuilding integrations each time.

This is what turns Ascent from a starting point into a platform.

Ascent is designed so that value compounds as the platform grows. Growth strengthens the platform and makes it even more powerful.

Arjun Sahgal

Business and Consumer

One platform. Many expressions.

Lending, applications, servicing, reviews, and renewals are different expressions of unifed data in one platform.

What Comes Next

One platform. Built to grow.

Teams start small, go live quickly, and expand flows over time without disruption or rip-and-replace.

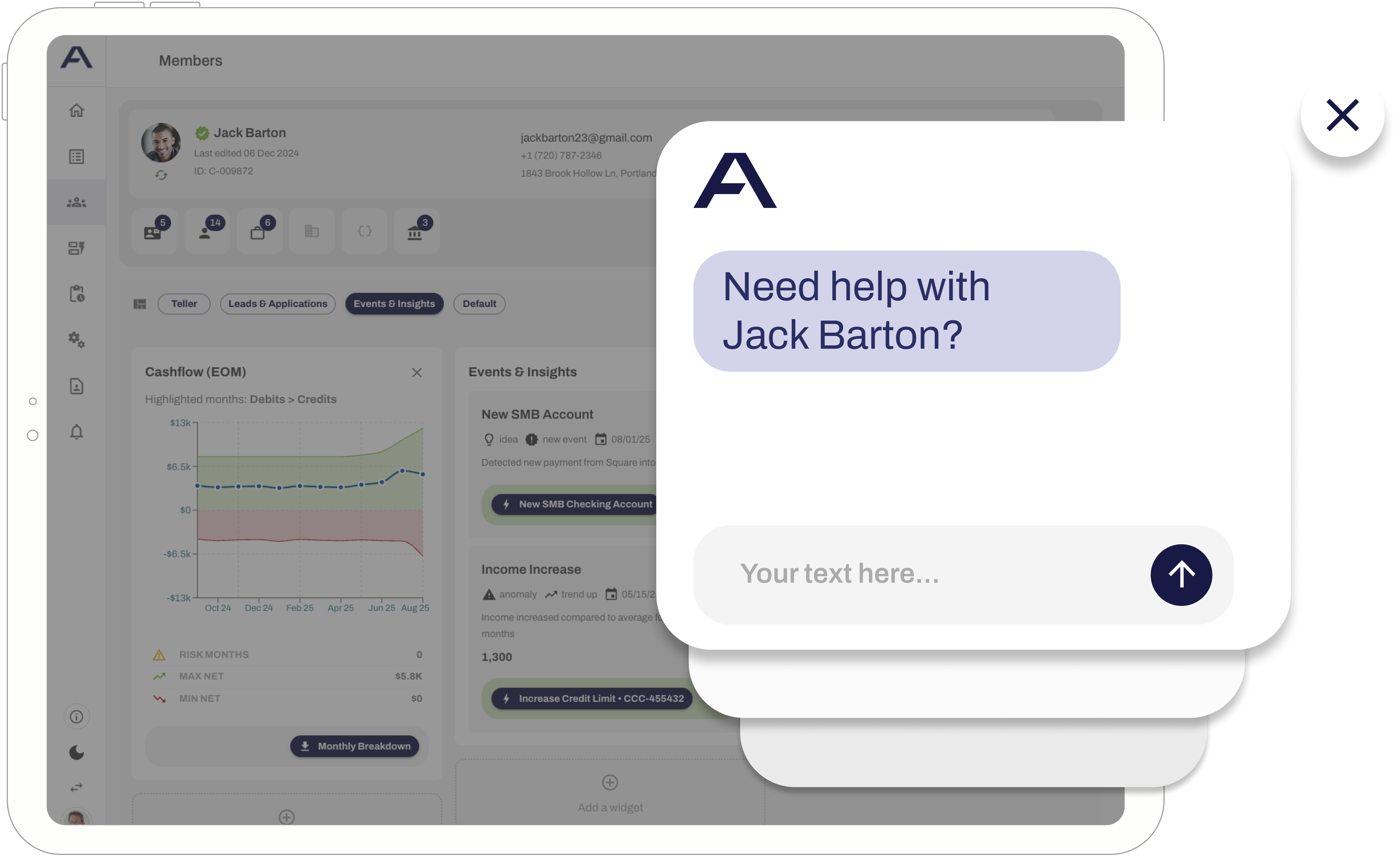

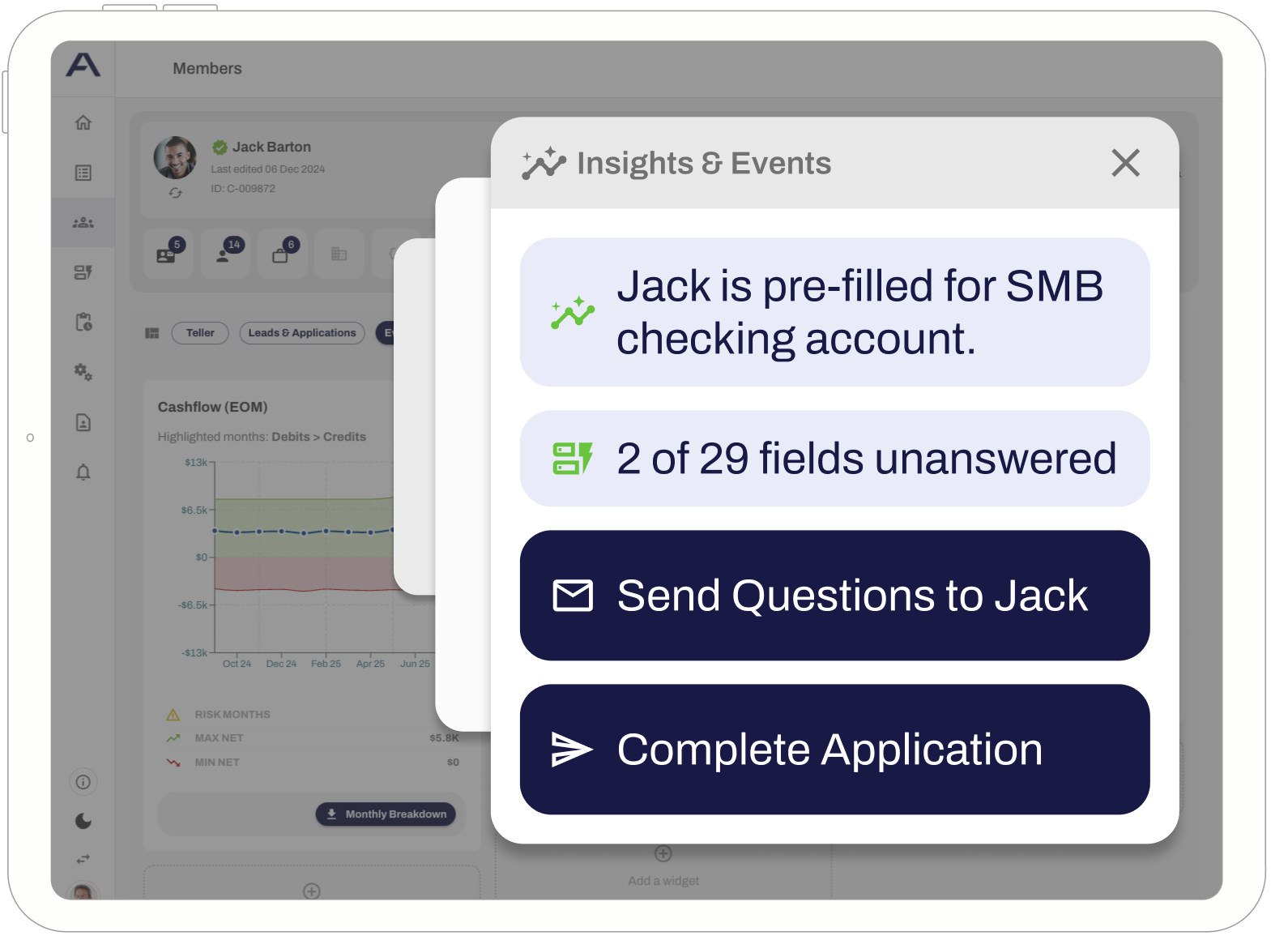

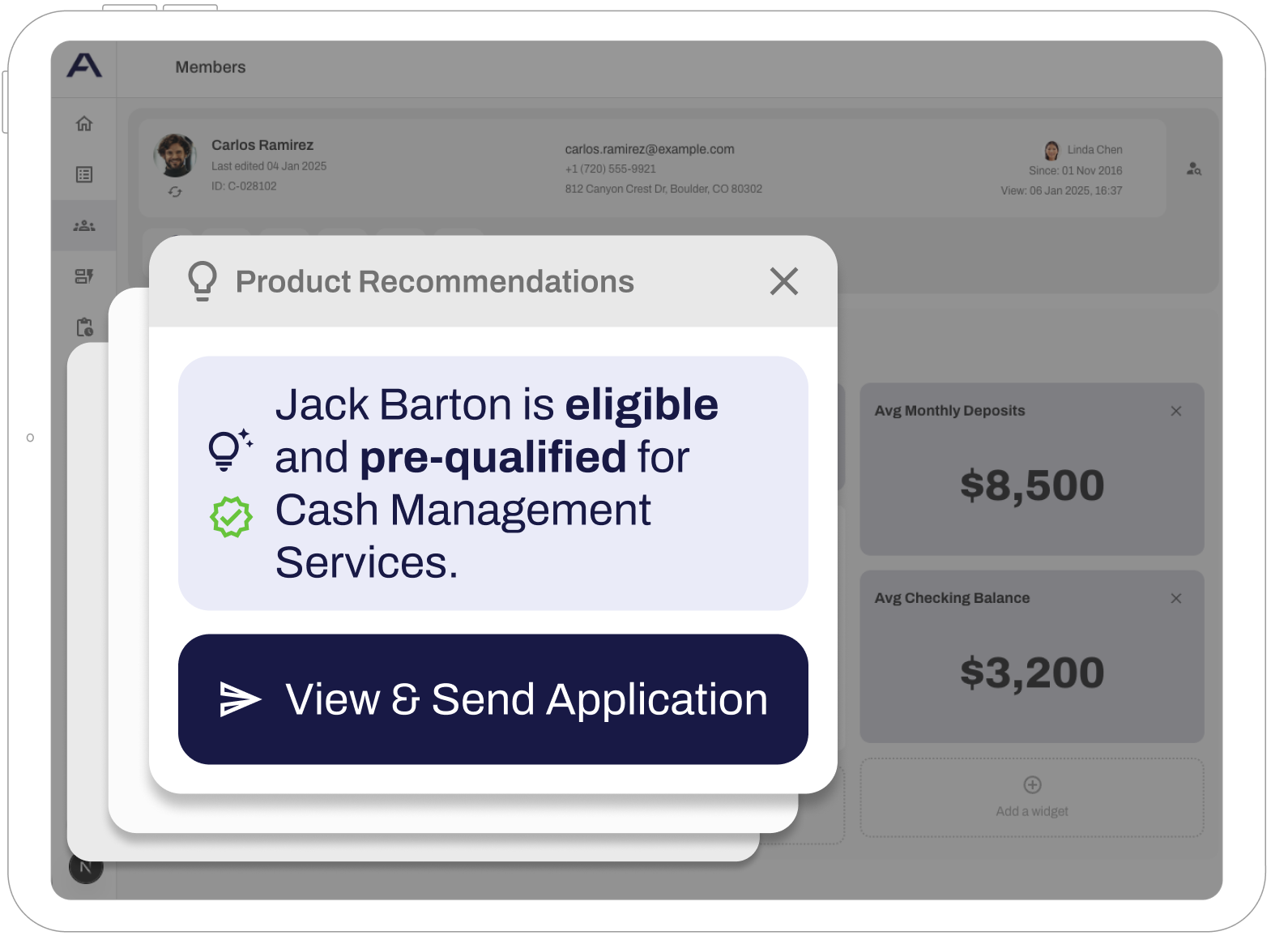

AI That Can Actually Act

AI only works when it has context.

Because Ascent maintains shared context across systems and over time, AI operates on the full relationship, not inside individual silos. That makes it useful, trusted, and actionable.

AI in Ascent does not replace judgment. It helps teams prioritize work, surface what matters, and move execution forward with confidence.