Ascent for TSLA

Welcome to Ascent Platform.

Level-up your Trustage Loan Application system with a modern, consistent, and easy-to-use platform that learns more about the member with each interaction.

Jun 20, 2025

3 min read

Case Study: Members Preferred Credit Union moved from Loanliner.com to Ascent

Josh Johnson, (VP Lending) said that the transition was designed to be invisible to members - and it was...

Every application,

Every form,

One experience

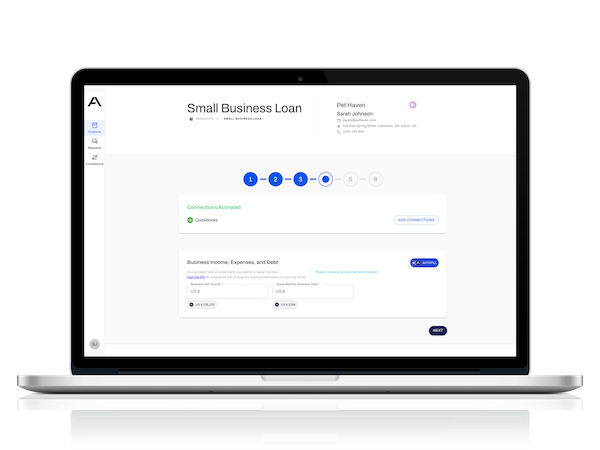

Ascent's Experience Platform merges the best capabilities of Trustage Loan Application with a modern digital platform. Quickly and painlessly upgrade your existing loan applications with beautiful, feature-rich experiences that engage your members and provide greater efficiency for your lenders.

Ascent replicates your existing TSLA applications, but also includes advanced features such as pre-filling applications and forms with external 3rd party data (such as banking, accounting, tax information), optionally applying rules to pre-screen applicants, and speeding document collection where needed. This flows into your systems of record (LOS, core, etc.) to finish a review, board a product, or complete a process.

Ascent also lets you replace your institution's patchwork of full-stack product applications, static web forms, and PDFs with one system. Using our no-code builder, you can easily add other product applications and forms at your own pace. Start with one of over two dozen templates to rapidly configure, test, and launch.

Ascent is white-label, featuring your brand, your questions, and your rules. There is no tear-out and minimal change to your existing processes. Deployment is white-glove with no engineering required and minimal IT involvement: start with your existing TSLA applications, and then add additional applications and forms in just weeks!

Accelerate member acquisition, improve cross-sell and member retention, make your team more efficient and productive.

Ascent's Consumer Suite for Loanliner.com customers

Schedule a demo now!