Small Business Lending

A High-Impact Place to Start

Start your Ascent journey here

Small business lending is often the moment a relationship is truly formed. It is one of the few times a business owner is willing to change institutions, move deposits, and reconsider how they bank day to day.

That makes lending a powerful starting point, and a risky one if the experience falls flat.

Ascent delivers a best-in-class small business lending experience while laying the foundation for deeper, longer-term relationships.

Business deposits are highly sought after because of their size and stickiness. They are also difficult to win. Business owners will only make a change when the experience feels clearly better, more thoughtful, and easier than what they are used to.

With Ascent, institutions can design fast, flexible lending workflows that adapt to each borrower. Using an intuitive no-code builder, teams create customized applications aligned to their strategy, not a rigid template. Applications dynamically reduce unnecessary questions as information is gathered, helping borrowers move through the process quickly and confidently.

Borrowers can connect to trusted third-party data sources such as QuickBooks, Plaid, and the IRS to reduce manual entry and improve accuracy. This leads to lower abandonment, higher engagement, and better conversion rates, without increasing operational burden.

Ascent also streamlines internal work. Configurable prescreening rules and automatic validation reduce manual review. Lending workflows can intelligently present related products, such as overdraft protection, business credit cards, or combined loan and deposit onboarding, without forcing separate processes. All information flows directly into your LOS, core, and other systems of record, preserving context beyond the loan itself.

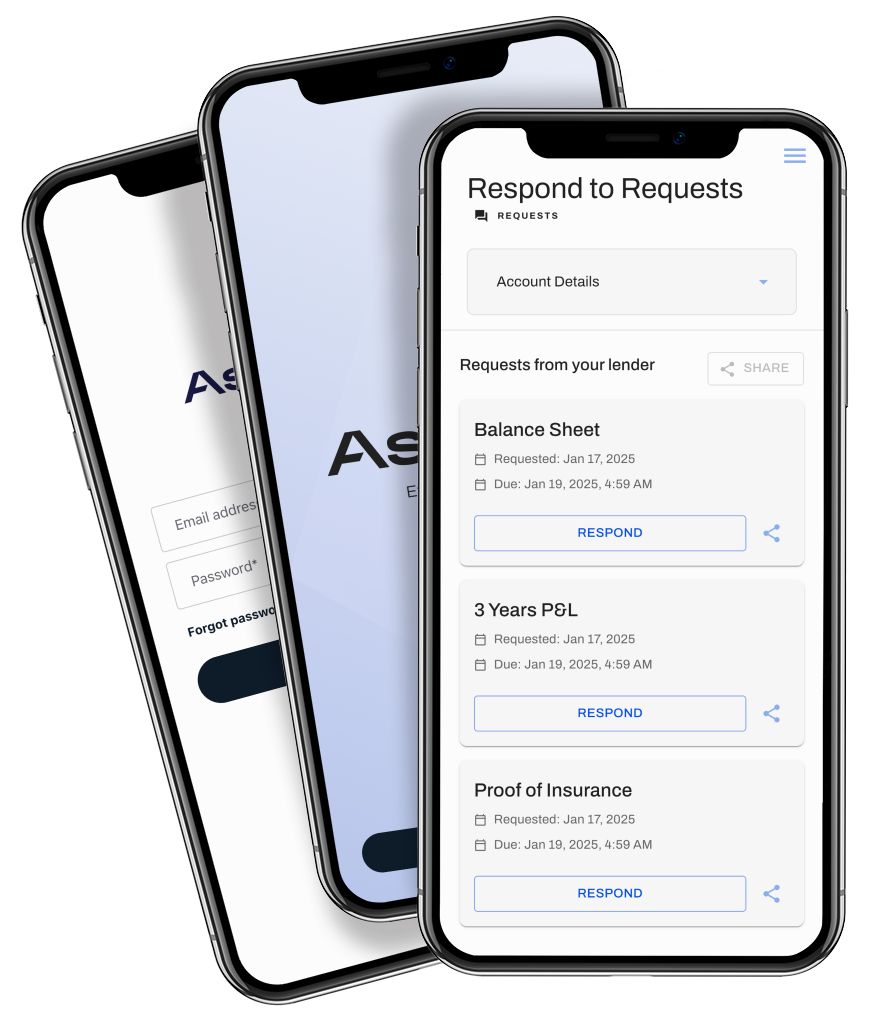

Lending becomes collaborative rather than transactional. Built-in messaging, proxy applications, and shared document collection allow borrowers and bankers to work together in real time, accelerating decisions and improving the quality of conversations.

Many tools can help you originate a loan. The difference shows after the loan closes.

For many institutions, small business lending is a natural place to begin with Ascent. It delivers immediate improvements in speed and experience, while establishing unified data that supports deposit growth, treasury adoption, reviews, renewals, and ongoing relationship management.

Why this is a powerful starting point

Lending is often the moment a business is willing to move deposits and deepen the relationship. Starting here allows institutions to capture that momentum and carry context forward.