Mortgage Point of Sale

A Better Starting Point for the Full Relationship

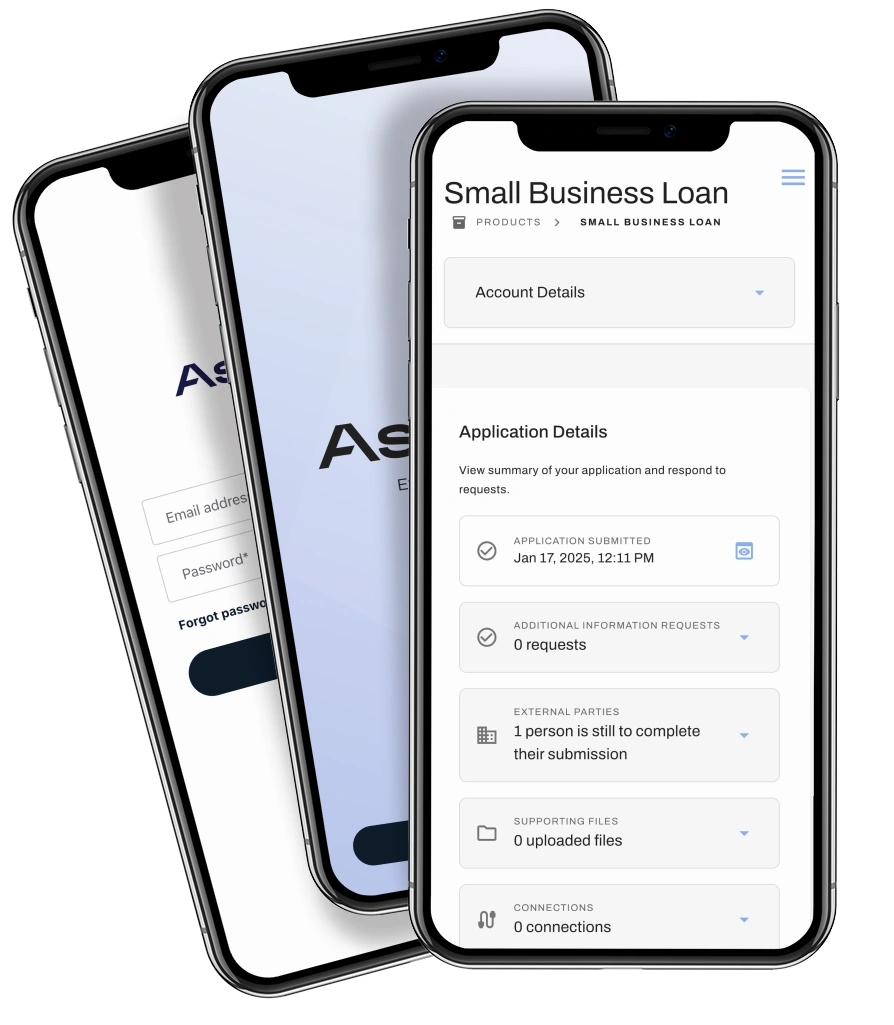

Start your Ascent journey here

Mortgage is one of the most complex and visible experiences an institution delivers. It's high stakes for borrowers, operationally heavy for lenders, and often the point where data fragmentation causes the most friction.

It is also a powerful place to start.

Ascent delivers a modern, real-time mortgage point of sale experience while laying the foundation for a connected borrower relationship that extends well beyond origination.

Borrowers experience a fast, intuitive digital journey designed around your questions, flows, and brand. Lenders gain richer, more reliable data from the very first interaction. But Ascent is not just a point-of-sale system. Its underlying data platform continuously understands prospective and active borrowers, rather than treating applications as one-time events.

Ascent connects to third-party sources for cash flow, credit, and fraud data, and combines that information with your rules and credit policy to automate pre-qualification decisions and borrower communications. During the full application process, borrower profiles are reused to pre-fill and pre-score applications in seconds, reducing friction and accelerating approvals. All results flow directly into your LOS, preserving context instead of recreating it.

Document collection is fast and integrated, keeping borrowers moving and lenders focused on decisions rather than coordination.

The difference becomes most apparent after the loan closes.

Once boarded, Ascent continues to monitor borrower data across servicing, CRM, and other systems of record. When a borrower's financial picture meaningfully improves or deteriorates, Ascent surfaces that change and can route the borrower back into an origination or engagement flow. Opportunities for refinancing, HELOCs, or additional consumer credit are identified based on real signals, not guesswork.

Many tools can help you originate a mortgage. The limitation shows when origination ends.

For many institutions, mortgage is a natural starting point with Ascent. It improves the borrower experience immediately, while establishing shared data that supports servicing, retention, and future lending without rebuilding workflows or re-integrating systems.

What makes this different

Mortgage data doesn’t disappear after origination. In Ascent, it continues to inform servicing, retention, and future lending opportunities.