Consumer New Account Opening

A Familiar Place to Start, Done the Right Way

Start your Ascent journey here

Consumer account opening is one of the most visible moments in a relationship. It is where first impressions are formed and where many institutions lose customers before the relationship even begins.

It is also one of the safest and most common places to start modernizing.

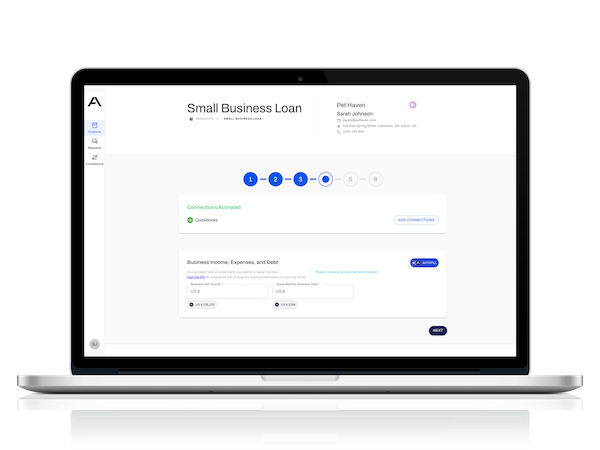

Ascent delivers a flexible, best-in-class consumer account opening experience that removes friction for applicants and gives bankers back control, while laying the foundation for a more connected way of working.

Credit unions still have real advantages over neobanks: product breadth, trust, and the ability for bankers to engage directly with customers. Those advantages are often undermined by rigid, siloed digital applications that force customers to start over when they need help or switch channels.

Ascent breaks down the barrier between digital and banker-led experiences. Institutions can support self-service, banker-led, or hybrid account opening flows, allowing customers to engage on their own terms. Bankers can pick up an application midstream, start one on a customer's behalf, or hand it back digitally for completion and signature without losing context.

Teams can design account opening workflows that reflect their product strategy and operating model. Applications can combine primary accounts with ancillary products, offer optional add-ons, or blend deposit and credit products into a single experience, all without rigid templates.

Ascent connects to third-party services for KYC, fraud checks, and external banking data, allowing applications to be pre-filled, prescreened, and completed faster. Data flows bidirectionally into your core, CRM, and other systems of record, preserving context beyond the initial application. Where required, integrated document collection completes the process cleanly and efficiently.

Many tools can help you open a consumer account. The difference is what happens after the account is open.

For many institutions, consumer account opening is a natural place to begin with Ascent. It delivers immediate improvements in conversion and experience, while establishing unified data that can later support lending, servicing, cross-sell, and long-term relationship management.

Why institutions start here

Consumer account opening is highly visible, easy to modernize, and quick to improve. It’s a familiar place to start without disrupting downstream systems.