Use Cases

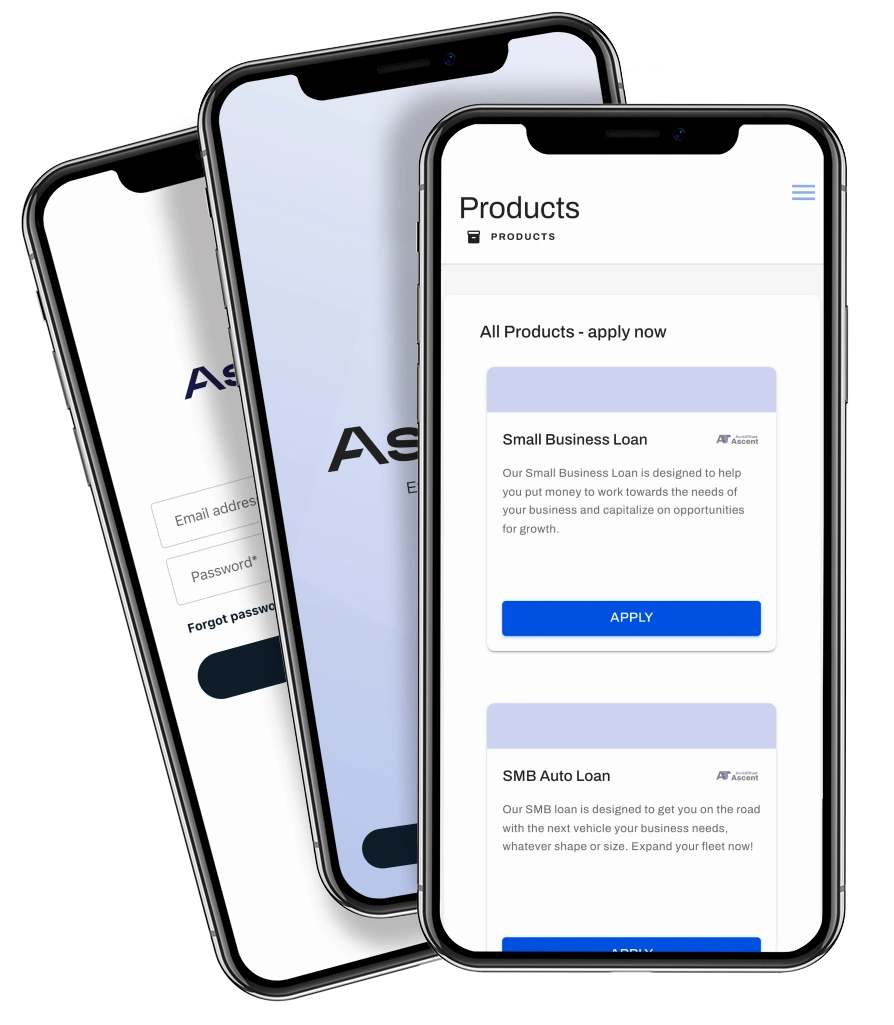

Imagine a beautiful and consistent experience for every digital touchpoint across the institution. Ascent streamlines and simplifies any and all product applications and forms without disrupting your existing systems and processes.

Consumer Banking

Starting with a blank application or form makes customers feel as if you don't know them.

By leveraging a persisted view of the customer, Ascent eliminates this problem by prefilling questions and making the experience more contextual. Whether it's reducing abandonment in new account opening, simplifying credit applications, or making mundane forms more convenient, Ascent makes interactions easier, faster, and less stressful -for the customer and the banker!

Commercial Banking

Commercial banking products and services are among the most profitable and complicated offerings in any institution.

Use Ascent to create efficient intake experiences, guide document collection and prep work, then route the loan package into your LOS. Also Ascent breaks one of the main barriers to commercial loan growth: automated reviews and renewals. Ascent drives timely communications and workflow for borrowers and lenders. It automatically creates the renewal file, including collection of financials and tax returns from permissioned sources, such as QuickBooks and the IRS.

Wealth Management

High-value relationships demand white-glove treatment, including your digital engagement.

Ascent lets you offer a beautiful and consistent experience for every aspect of the customer journey, and provides your bankers with the visibility and tools to seamlessly communicate and collaborate with customers on their own terms.

Mortgage Lending

It's highly competitive - winning or losing often comes down to the application experience.

Ascent delivers a friendly and convenient mortgage point-of-sale experience for both borrowers and lenders. Offer a pre-qualification experience customized to your policies and the needs of your customers. Route the full application into your mortgage LOS for analysis and approval.

Treasury Services

Streamlining treasury activities improves retention and can grow both interest and non-interest income.

Ascent can streamline enrollment in ACH, wire, and other payment rails, automate limit increase applications and decisioning, and even dynamically manage your exposure across multiple rails.

Technology & Operations

Solving experience problems one-at-a-time is expensive, resource-consuming, and disruptive.

It also increases IT overhead and compliance management costs. It often results in a new set of fragmented and silos experiences, and you never address the long-tail of static webforms and PDFs. Ascent levels-up all of these experiences-from the most complex to the most mundane-on a single platform. Plus, our no-code builder puts you in control of the priority and timing of deployments.

Risk & Compliance

Using your compliance and monitoring practices, get alerted to exceptions and stay in compliance.

Ascent is built to provide a persistent view of your customer's financial health. Automatically refreshing and analyzing both internal and external customer data, Ascent can also generate alerts based on your thresholds that indicate improving or deteriorating financials. Ascent can track quality control in originations and servicing. Ascent tracks and timestamps all human and system interactions, making it useful for reporting and audit preparation.