Small Business Lending

Ascent's fast and flexible small business lending experience sets the stage for acquiring new business customers and deposits.

Business deposits are highly sought after because of their size and stickiness, but it's also why they are difficult to acquire: business customers need a big reason to make a change.

You only get once chance to convince business owners to switch to your institution, and you miss your chance if that first interaction is nothing special.

Use Ascent's Small Business Lending solution to offer a best-in-class experience that sets your institution above the competition. Ascent's intuitive, no-code builder empowers your team to design and deploy beautiful, customized applications based on your strategy and needs. Ascent learns from each customer interaction to dynamically reduce the number of required questions. Applicants can connect to QuickBooks, Plaid, and the IRS to further speed application completion and improve accuracy. This leads to less abandonment, higher engagement, and better conversion rates.

Additional features like configurable prescreening rules and auto-validation help streamline your team's workflow. Intelligently present ancillary products such as combo loan/LOC overdraft protection, or business credit card, or combine loan and new deposit account applications in a single flow. Borrowers and bankers spend less time manually working on applications, which means faster approval cycles, more time for meaningful conversations, and more cross-sell opportunities. All of this flows into your systems-of-record (LOS, core, etc.) to complete additional processing and board the loan.

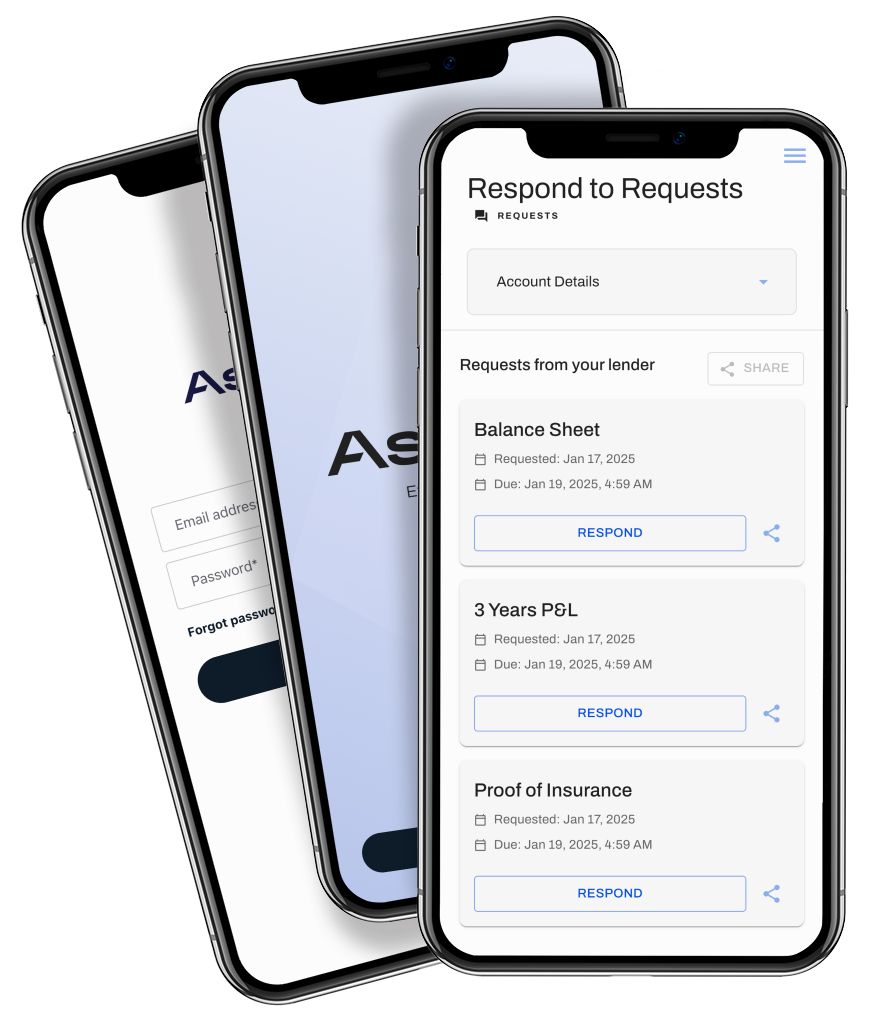

Ascent fosters collaboration between your borrowers and bankers. Through built-in tools like real-time messaging, proxy applications, and shared document collection, both borrowers and bankers can instantly communicate and resolve issues, accelerating decision-making.

Close more loans, grow business deposits, and deepen relationships with less effort and resources using Ascent.

From FinovateFall 2024, watch a full walk-through of a customer benefitting from Ascent's Prefill whilst applying for multiple products.

Not ready for a demo?

Glen Fossella

Head of Customer