Mortgage Point of Sale

Ascent centralizes your loan operations and seamlessly orchestrates the flow of borrower data across systems, allowing your team to focus on core business drivers.

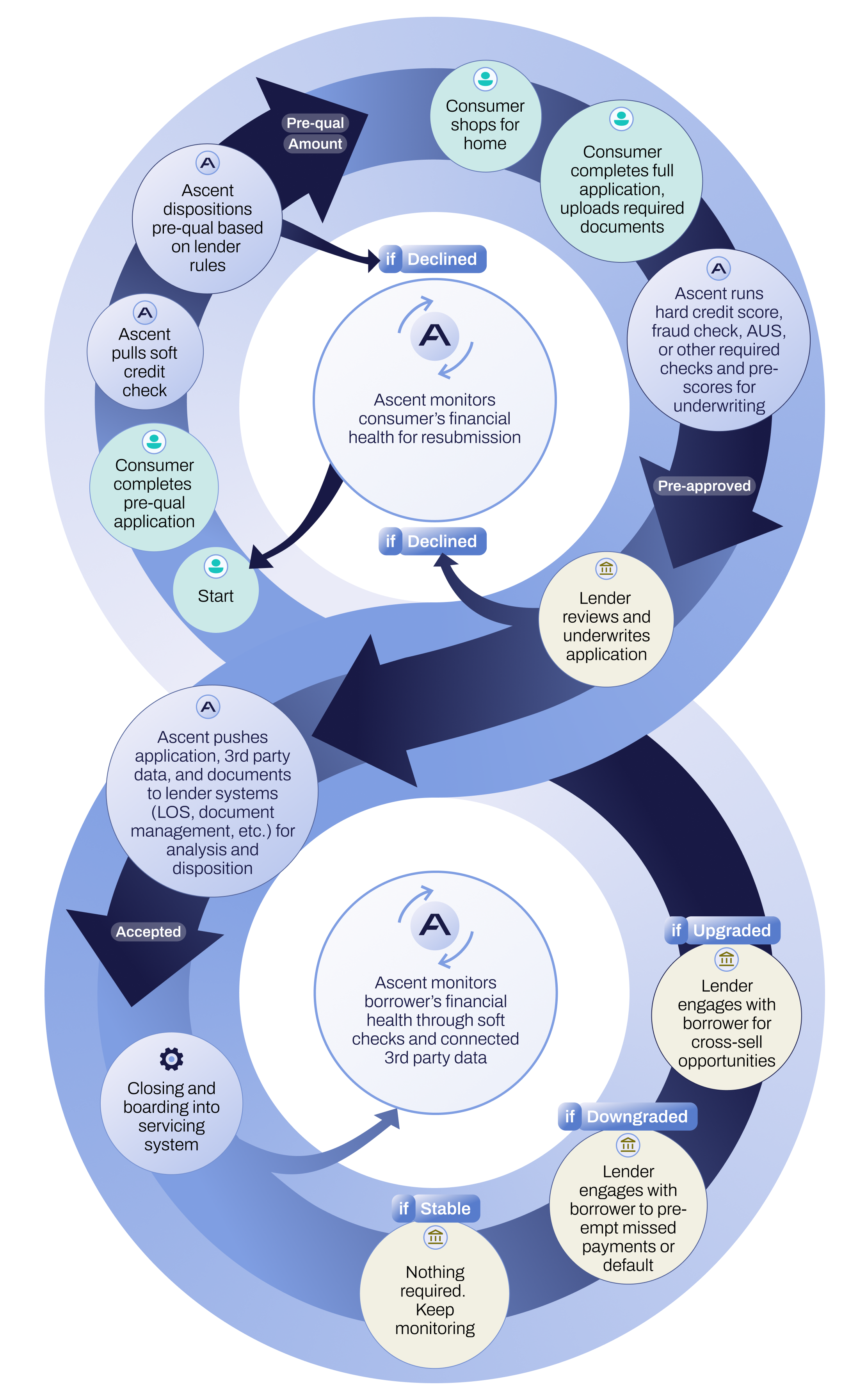

Ascent's solution delivers a real-time digital experience for borrowers and a richer data set for lenders. But it's not simply a point-of-sale system; Ascent's underlying data platform actively monitors prospective and current borrowers, tracking their financial health and alerting lenders throughout the mortgage lifecycle.

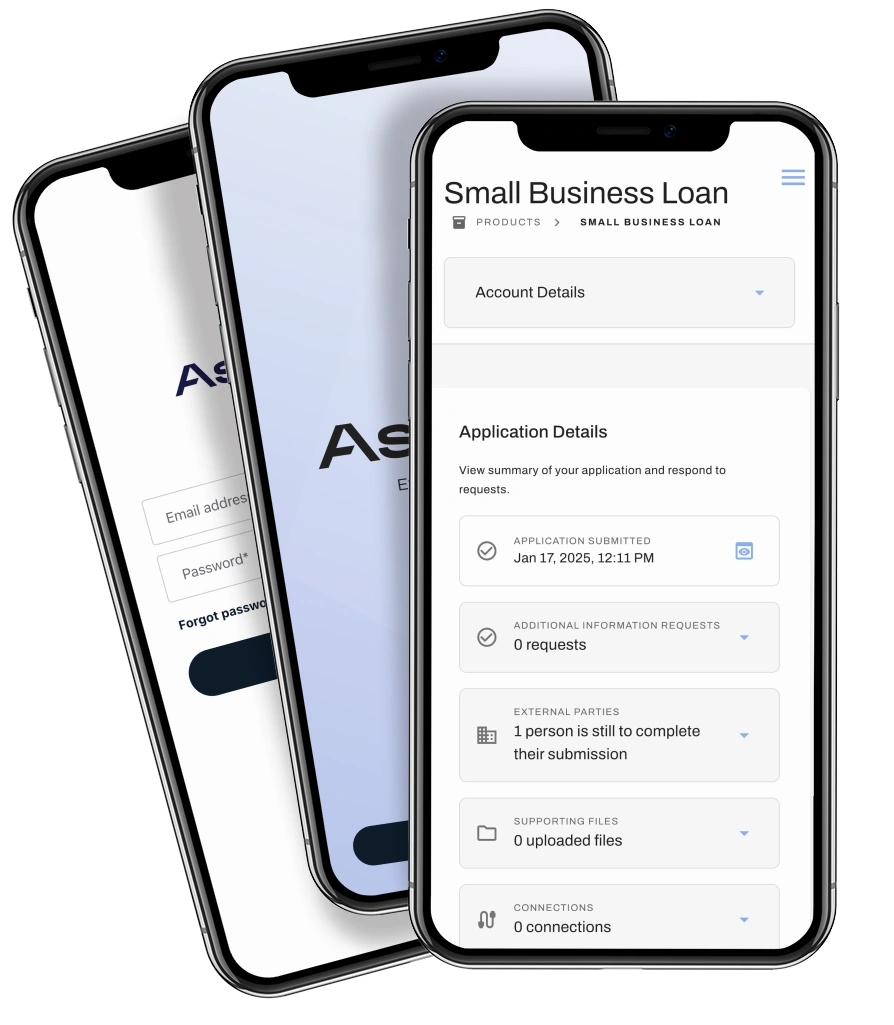

Featuring your questions, flows, and branding, Ascent consumes 3rd party data including cash flow, credit, and fraud data, and combines it with your rules and logic to automate pre-qualification approvals and borrower letters. During the full application process, Ascent again leverages the borrower's data profile to pre-fill and pre-score applications in seconds based on your credit policy, and then push the results into your LOS. Fast and convenient document collection completes the process, resulting in a game-changing experience.

Once boarded, Ascent continues to monitor the borrower, sharing data bidirectionally with your servicing platform, CRM, and other systems-of-record. Ascent alerts your team if the borrower's financial health improves or declines beyond preset parameters, and can route borrowers back into an origination cycle for follow-on product opportunities such as refinancing, HELOC, or other consumer credit products.