Business New Account Opening

Ascent goes beyond basic business account opening with a flexible platform that supports any and all non-credit product applications.

The needs of small business owners are complex, whether for deposit products, credit, or treasury services. They need and expect their bank to bring not only the products, but the expertise and guidance to help their businesses grow. But the best business banking effort will fall short if your digital engagement is rudimentary.

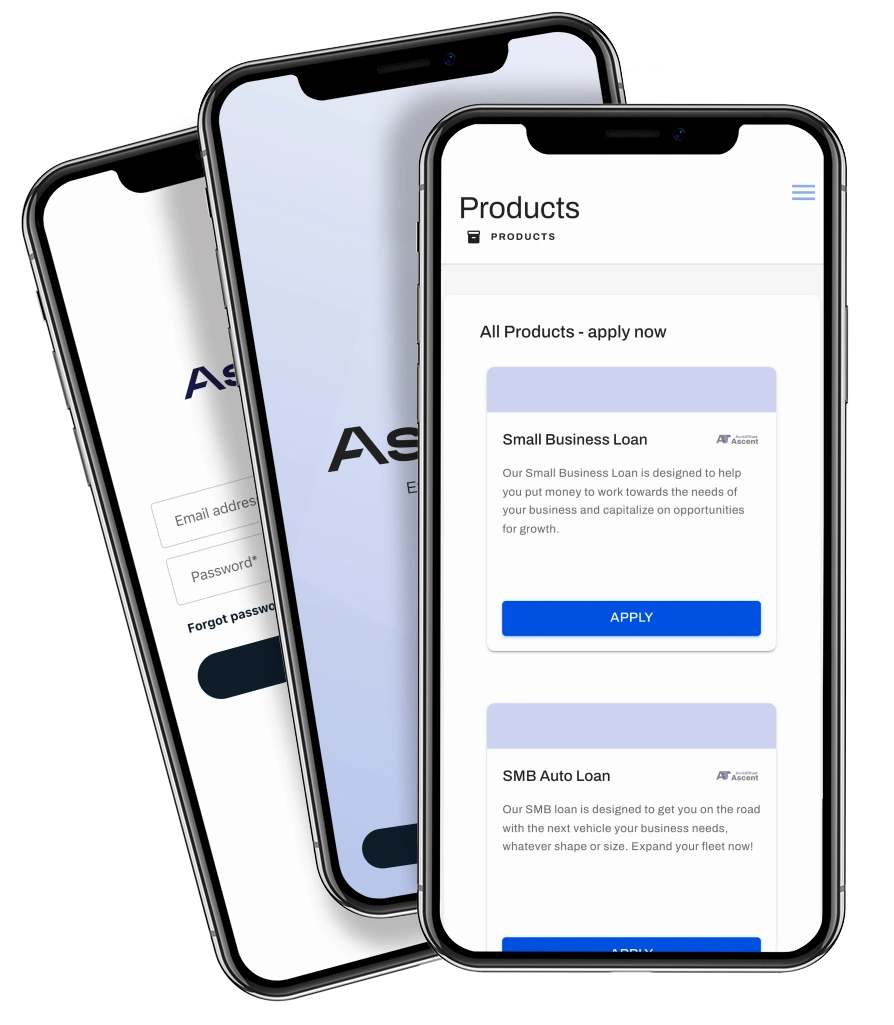

Ascent's Business New Account Opening enables financial institutions to deliver exceptional experiences for their new and existing business customers. Customizable workflows allow you to design virtually any kind of application flow, from stand-alone account applications to dynamic multi-product applications based on your rules and logic. Ascent streamlines processes, enhances efficiency, and builds trust through consistent, intuitive interactions.

Customers can connect with leading 3rd-party data sources like Plaid, QuickBooks, IRS, Alloy, and IDology to minimize manual data entry, reduce keystrokes, and expedite completion. Ascent applications are dynamic and only display only relevant fields to applicants, ensuring a fast and simplified experience. All of this flows into your core and other systems-of-record to complete the boarding process.

Ascent also fosters collaboration between your customers and bankers with built-in tools like real-time messaging, proxy applications, and shared document collection. Customers and bankers can instantly communicate and resolve issues, accelerating decision-making. The banker portal puts collected information at bankers' fingertips, giving them a complete view of the customer and engendering more meaningful conversations and better outcomes.

Create seamless, intuitive digital experiences that build trust and loyalty, dramatically reduce time-to-completion for applications, and equip your bankers with data-driven insights for better decision-making.

From FinovateFall 2024, watch a full walk-through of a customer benefitting from Ascent's Prefill whilst applying for multiple products.

Not ready for a demo?

Glen Fossella

Head of Customer