CCUA and Ascent Partner to Deliver Next-Generation Experience Platform

Aug 20, 2024, 09:00 ET

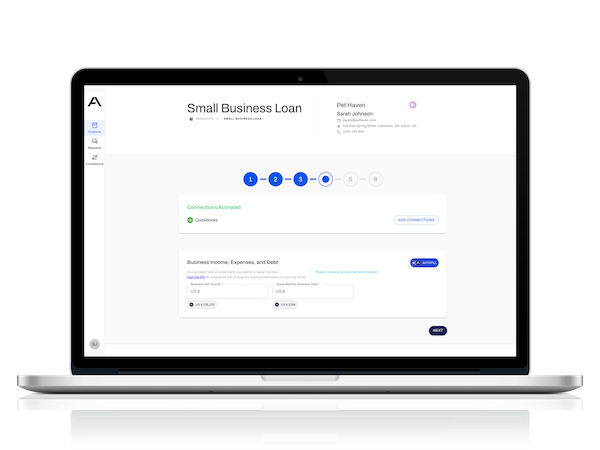

Ascent reduces work for both members and associates when completing digital applications and forms.

The Cooperative Credit Union Association (CCUA) proudly announces a strategic partnership with Ascent Platform, a CUSO and leading fintech in digital experience solutions for credit unions, to help CCUA members improve digital engagement and delivery.

Traditionally, a credit union would need to deploy a full-stack, turnkey solution for every experience problem. These solutions improve experiences but are expensive, complicated, and time-consuming to implement. They also disrupt operating processes, add to compliance and vendor management costs, and can also add risk. And ultimately, a credit union ends up with a brand new set of fragmented UIs and siloed data.

Ascent solves the fragmented experience problem by enabling credit unions to deploy beautiful and consistent experiences for every digital touchpoint across the institution. Ascent streamlines and simplifies any and all product applications and forms without disrupting existing systems and processes.

Ascent replaces the patchwork of full-stack product applications, static online forms, and PDFs with intelligent forms featuring pre-filled data, optional pre-screening rules and logic, and collaborative document collection. Most importantly, Ascent learns from every interaction, and uses those learnings to make subsequent experiences more contextual, with fewer questions for the member and less work for the associate.

"CCUA is one of the leading voices in the credit union movement and we are excited to partner and learn how we can best serve their membership," explained Arjun Sahgal, co-founder and CEO of Ascent. "Working with Melissa Pomeroy and the CCUA team has already been rewarding; we look forward to building on that momentum."

"Partnering with Ascent enables us to offer a cutting-edge digital experience that boosts both member satisfaction and operational efficiency," said Melissa Pomeroy, EVP and Chief Operating Officer at CCUA. "This collaboration aligns seamlessly with our mission to empower credit unions through collaborative innovation."

"Partnering with Ascent enables us to offer a cutting-edge digital experience that boosts both member satisfaction and operational efficiency. This collaboration aligns seamlessly with our mission to empower credit unions through collaborative innovation."

Melissa Pomeroy, EVP and Chief Operating Officer at CCUA.

About the Cooperative Credit Union Association

The Cooperative Credit Union Association (CCUA) is the leading regional trade organization, acting as the advocate for nearly 200 credit unions spanning Delaware, Massachusetts, New Hampshire, and Rhode Island. These member credit unions collectively manage assets exceeding $75 billion, serving a combined membership of over 4.8 million consumers. Visit www.ccua.org for more information.

About Ascent Platform

Ascent is the next-generation platform that provides financial institutions with the ability to streamline any and all product applications and forms without disrupting existing systems and processes. Ascent replaces the patchwork of full-stack product applications, static web forms, and PDFs with intelligent applications and forms featuring prefilled data, optional pre-screening rules and logic, and collaborative document collection. Most importantly, the platform learns from every interaction, and uses those learnings to make subsequent experiences more contextual, with fewer questions for the member and less work for the associate. Using Ascent’s no-code builder, institutions can rapidly configure and deploy beautiful bespoke applications and forms at their own pace.

Glen Fossella,

Head of Customer

617-335-2181