Ascent Successfully Completes SOC 2 Type II Audit

Apr 15, 09:00 ET

Third-party auditors confirm the company's mature security practices, reaffirming Ascent's commitment to their partners and customers

Ascent Platform Corporation, the next-generation Point-of-Sale platform that streamlines financial product applications for banks and credit unions, announced today that it has successfully completed its Service Organization Control (SOC) 2 Type II certification, achieving compliance with the leading industry standards for customer data security. This report shows Ascent's ongoing commitment to providing a secure data environment for its partners and customers.

Developed by the American Institute of Certified Public Accountants (AICPA), a SOC 2 information security standard is a report that validates controls relevant to security, availability, integrity, confidentiality, and privacy. The audit was completed with the help of Johanson Group LLP, a premier certification body helping organizations to obtain and maintain global compliance standards.

Johanson Group attested to Ascent's information security controls meeting the leading industry standards for financial services. Johanson Group specializes in SOC 2 audits and provides audit and professional services to public and private companies, large and small, in a variety of industries.

SOC 2 has a rigorous requirement on how companies handle customer data and information, so compliance guarantees that established and implemented organizational practices are in place to safeguard customer data.

“Ascent is committed to providing strong controls over PII and mission-critical data for our bank and credit union clients,” said Arjun Sahgal, Ascent co-founder and CEO. “Data integrity and security is a fundamental part of how Ascent manages information, and SOC2 Type II compliance represents our commitment to secure systems and controls.”

About Ascent Platform

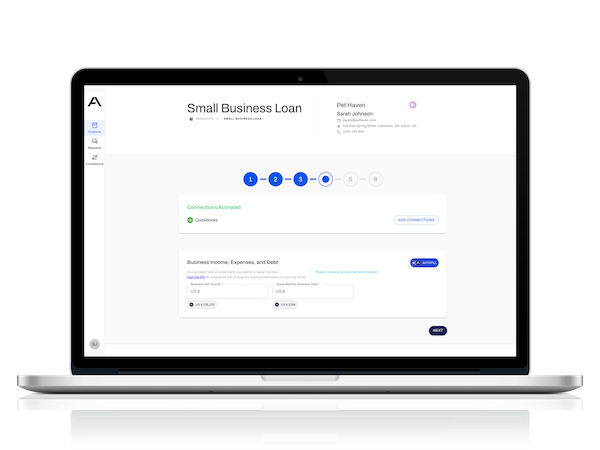

Ascent is the next-generation platform that provides lenders with the ability to streamline any and all product applications and forms without disrupting existing systems and processes. Ascent replaces the patchwork of full-stack product applications, static web forms, and PDFs with intelligent applications and forms featuring prefilled data, optional prescreening rules and logic, and collaborative document collection. Most important, the platform learns from every interaction, and uses those learnings to make subsequent experiences more contextual, with fewer questions for the customer and less work for the lender. Using a no-code builder, institutions can rapidly configure and deploy beautiful bespoke applications and forms at their own pace. For more information, please visit ascentplatform.io.

Glen Fossella,

Head of Customer

617-335-2181