For BaaS Providers: Navigate Regulatory Challenges and Drive Profitable Growth using Ascent

As a BaaS provider, you've helped transform the financial landscape, enabling non-financial institutions to create and deliver unique banking services. However, as we enter 2024, the industry faces regulatory risks, price pressures, and diminishing returns. How do you meet the dual challenge of implementing proper controls and oversight, while enabling your neobanks to grow and attain profitability?

Jan 22, 2024

Break down barriers to visibility and control using Ascent's Permissioned Data Core and lending add-ons. Using Ascent, you can merge data from your neobank's 3rd party systems (such as KYC/AML) with your core and other bank systems, plus other 3rd party data sources to create a single view of neobank activity. Add Ascent's Lending as a Service offering to provision lending products to your neobanks based on your policies and procedures.

FEATURES

Control and Compliance

- Centralized and persisted view of data across neobank systems (KYC/AML, etc. ), your systems-of-record (core/servicing system, treasury, payments) and permissioned 3rd party data (Plaid, QuickBooks, Experian, etc.)

- Searchable, shareable audit trail that automatically logs all user interactions and system activity

- Build and apply custom criteria aligned with your policies and procedures across the holistic data set

- Generate exceptions and follow-up tasks based on real time information; no effort wasted on manual reviews or intervention where criteria are met

- Prepare for audits by building and running queries based on expected reporting requirements

- Ease of access to ad hoc data when required; query anything across all data sets

Flexible Lending as a Service

- Offer a flexible lending platform to your neobanks, allowing them to enter the lending business within a framework determined and managed by you

- Preconfigure compliant lending products, set ratio and decisioning ranges and rules

- Neobanks can choose from the products you’ve defined, use their own branding and credit policies within your preset values

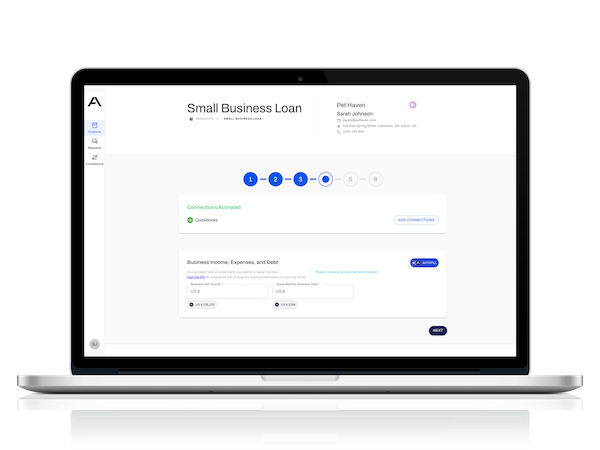

- Quick and easy digital loan applications, prefilled with core and 3rd party data (Plaid, QuickBooks, Experian, etc.)

- Intuitive borrower portal lets borrowers and lenders collaborate on document collection and other tasks

- Full-featured lender portal provides loan officer, underwriter, and loan operation views and tools, along with management capabilities

- Integrates with your LOS if desired or other loan systems in use by your neobanks