Empowering the Universal Banker Model with Ascent: Overcoming Operational and Technological Barriers

July 15, 2025

Executive Summary

The Universal Banker concept was introduced as a solution to one of modern banking’s biggest challenges: a reduction in foot traffic, driving changes to branch economics. Concurrently, improving branch automation opened the door to more consistent in-branch processes that would improve customer service, reduce the need for specialization, and expand employee roles. At its best, the model creates a single point of contact for all customer needs, blending service, advice, and sales in one seamless interaction.

But for many institutions, especially smaller community banks and credit unions, the model remains an unrealized ideal. Implementation challenges have proved more daunting than expected. Fragmented software systems, high turnover, and even cultural issues plagued universal banker projects and often turned ambitious strategies into daily operational struggles.

As The Financial Brand recently noted, resource limitations have kept most smaller institutions from deploying Universal Banker programs successfully. Ascent changes that reality by making it easy to deliver a consolidated view of the customer without a heavy IT or data lift. Ascent delivers real-time customer insights and the ability to act on them, helping financial institutions unlock the true potential of the Universal Banker.

The Challenge:

Why the Universal Banker Model Struggles in Practice

Financial institutions are highly motivated to evolve as they face constant pressure to increase agility, reduce costs, and strengthen customer relationships. The Universal Banker model was introduced as a solution to these challenges by combining multiple branch roles into a single position, fostering a more flexible and responsive frontline.

However, without significant changes in training, technology, and workflow support, the model typically faltered before being fully implemented.

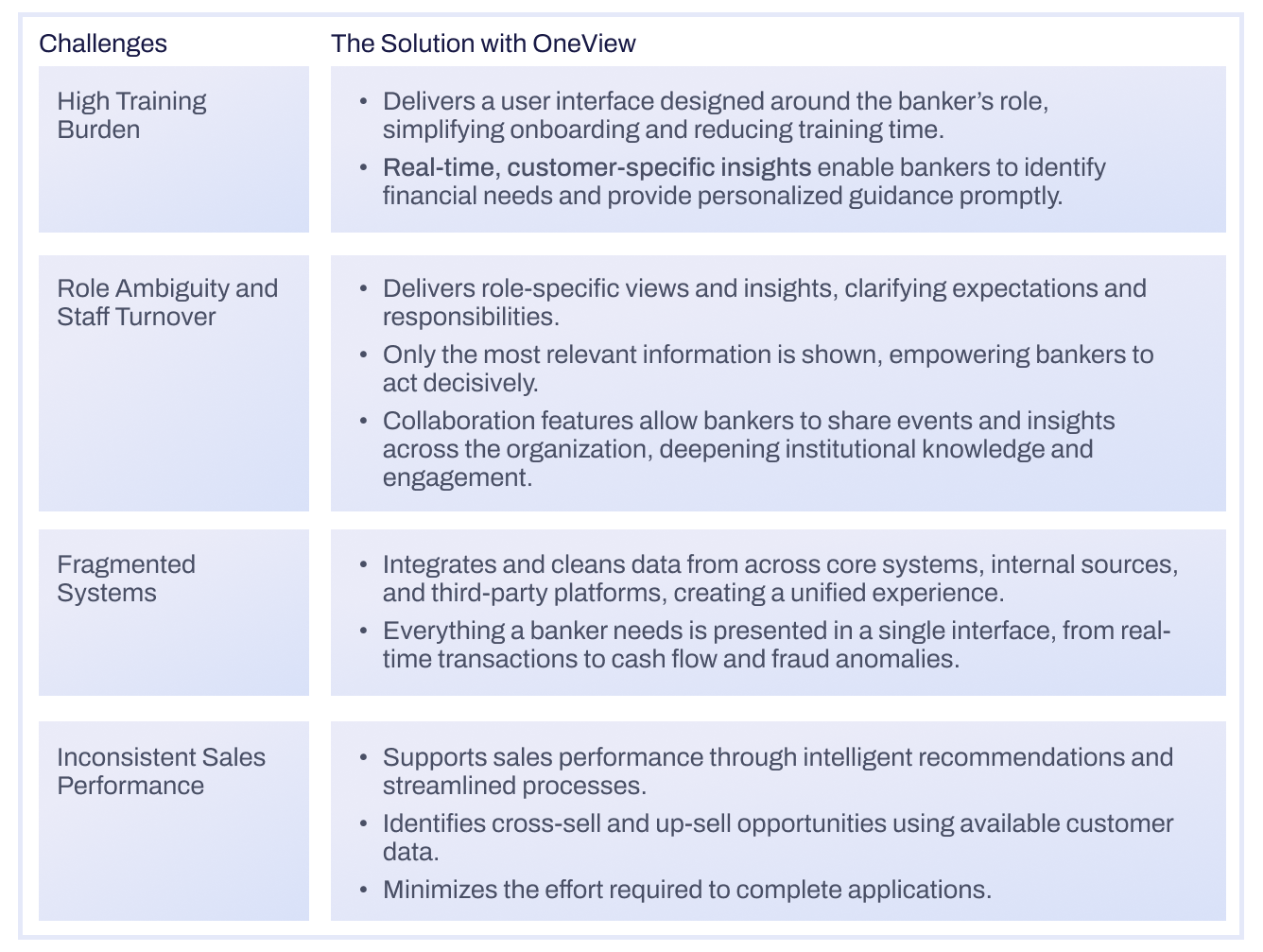

One of the primary challenges is the steep learning curve. Universal Bankers are expected to fulfill the roles of teller, advisor, and product expert all at once. This requires a vast knowledge base that includes core systems, compliance procedures, product criteria, and interpersonal sales skills. For institutions lacking extensive training resources, the costs are high, and the new-employee onboarding process tends to be slow.

The issue goes beyond training, though. In many institutions, employees lack clear definitions of their responsibilities. When one role encompasses three different functions, it often leads to confusion and burnout. Without effective tools to simplify workflows and aid decision-making, staff engagement and retention can decline.

Technology exacerbates the problem, as most Universal Bankers must navigate a disjointed array of systems: one for core banking, another for customer relationship management (CRM), a separate system for documents, and yet another for analytics or fraud detection. These fragmented systems hinder performance and reduce the time available for what matters most: connecting with customers.

Even when operations are running smoothly, sales performance can still lag. Without timely access to the right data, cross-selling becomes challenging and ineffective. Customers may feel as though they are being sold to rather than genuinely supported. This results in missed opportunities and undermines the entire potential of the Universal Banker model.

And it’s not just about sales; customers want guidance in their financial lives, and that often means less-than desirable situations such as the loss of income or large, unexpected expenses. How bankers engage with the customer during such times will have a lasting impact on the relationship, whether for good or ill.

The Solution

A Unified Experience with Ascent

Ascent was purpose-built to resolve the friction at the heart of the Universal Banker model. Ascent provides each banker with precisely the information they need, right when they need it during customer interactions, all within one simple, easy-to-use interface. Rather than force employees to become experts across multiple systems and fragmented sources of information, Ascent manages all of that behind the scenes, abstracting away the in-branch complexities and presenting the banker with real-time insights regarding the customer’s financial situation, and enabling them to provide real guidance.

Training becomes dramatically simpler. Instead of memorizing workflows across systems, bankers are guided by context-aware prompts, personalized insights, and a UI aligned with their role. Customer-specific intelligence, such as recent transactions, spending patterns, or credit status, is delivered in real time, eliminating guesswork and enabling confident service from day one.

To address role confusion, Ascent creates clarity through design. Every user can configure a version of the platform tailored to their function. Frontline staff access tools and data specific to their daily responsibilities, while collaboration features let teams share notes and flag opportunities, creating transparency and continuity across the organization.

By eliminating the need to toggle between platforms, Ascent restores time and focus. It integrates data from core systems, internal tools, and third-party sources, delivering a 360-degree view of each customer. Whether reviewing cash flow, checking fraud alerts, or initiating a loan application, everything happens in a unified experience that works at the speed of conversation.

Sales performance improves as well. Ascent surfaces intelligent recommendations for cross-sell and up-sell, based on actual customer behavior and financial needs. The Proxy Application feature enables staff and customers to co-complete applications in real time, reducing abandonment and making the process feel personal and collaborative. And because Ascent has a consolidated data profile of the customer, new product applications only require a few pieces of information specific to the requested product instead of having to complete an entire application.

As one product expert put it, “Ascent empowers institutions to offer applications and forms where minimal information is needed, which means fewer keystrokes and a faster time to completion.””

However, Ascent goes beyond sales performance. By offering a complete picture of the customer, including cash flow and anomalous activity, a banker can engage the customer more meaningfully based on changes in their financial lives. For example, a dramatic drop in average balances or a missing direct deposit could indicate a financial challenge for the customer; armed with this information, a banker can engage the customer about possible problems and solutions.

Beyond Operational Efficiency

A Platform for Strategic Growth

While Ascent resolves the day-to-day operational burdens of the Universal Banker model, it also equips institutions for long-term success. Ascent provides tools for wallet share analysis, helping banks identify where customers are sourcing products externally, and what they can do to take that business away from competitors.

Built-in anomaly detection and fraud alerts proactively identify issues before they escalate, increasing customer trust. And because Ascent is built with future capabilities in mind, it sets the foundation for AI-driven automation and predictive analytics as institutions grow.

It’s not just about simplifying today’s work; it’s about making tomorrow’s work smarter.

Conclusion

Turning Struggle into Strength

The Universal Banker model remains one of the most compelling ideas in modern banking, if it can be implemented effectively. Ascent makes that possible. It provides institutions with the clarity, speed, and intelligence they need to enhance both customer service and staff performance, all without overwhelming teams or overhauling their infrastructure.

Where the Universal Banker once represented an ideal, it has now become a practical reality. And in an environment where customer expectations are higher than ever, that difference is transformative.

July 15, 2025

Download as pdf