Data Transformation by Design: How Ascent Unlocks AI-Ready Insights Without the Pain of a Data Migration

July 10, 2025

Executive Summary

Traditional data transformation initiatives in banking are notorious for their complexity, cost, and slow return on investment. Institutions are promised deep insight and innovation but are burdened with lengthy projects, IT dependencies, and organizational fatigue: often with little to show.

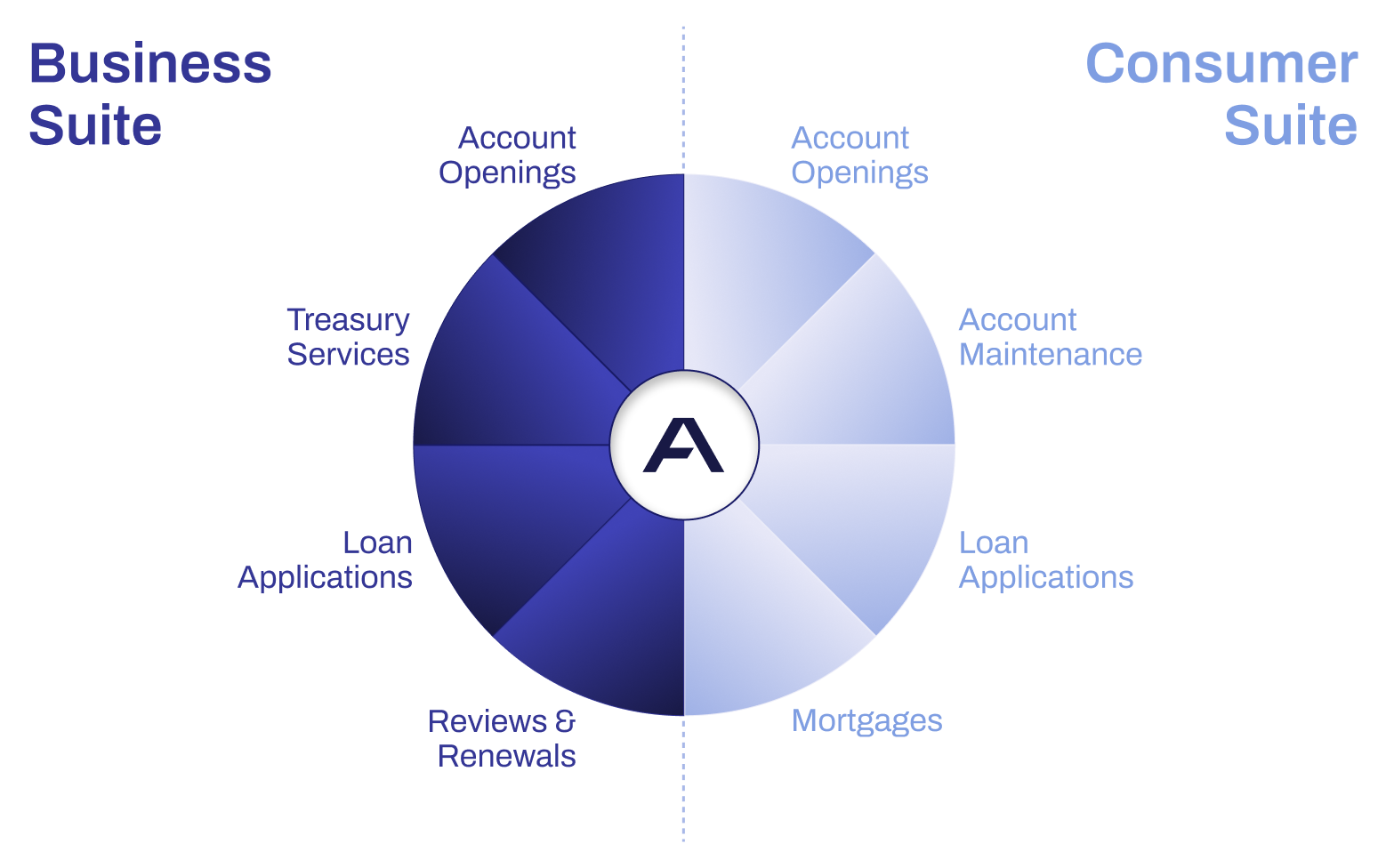

Ascent offers a different path. By embedding intelligent data capture into the core workflows of business and consumer banking, Ascent enables institutions to build a clean, centralized, and actionable data foundation without needing to invest in a standalone data platform or undergo a disruptive migration. The result: immediate business ROI with a long-term foundation for AI-driven growth.

The Traditional Problem:

Why Most Data Projects Stall

In theory, data transformation should provide banks and credit unions with a 360-degree view of their customers, enabling better service, reduced risk, and smarter decision-making. In practice, it rarely works that way. Financial institutions typically attempt transformation through large-scale investments in data lakes or warehouses. These efforts are time-consuming and expensive, requiring perfect integrations, deep internal alignment, and pristine data hygiene, none of which exist at the outset. Projects stall as priorities shift, IT capacity is stretched thin, and institutions struggle to align data strategy with day-to-day operational needs.

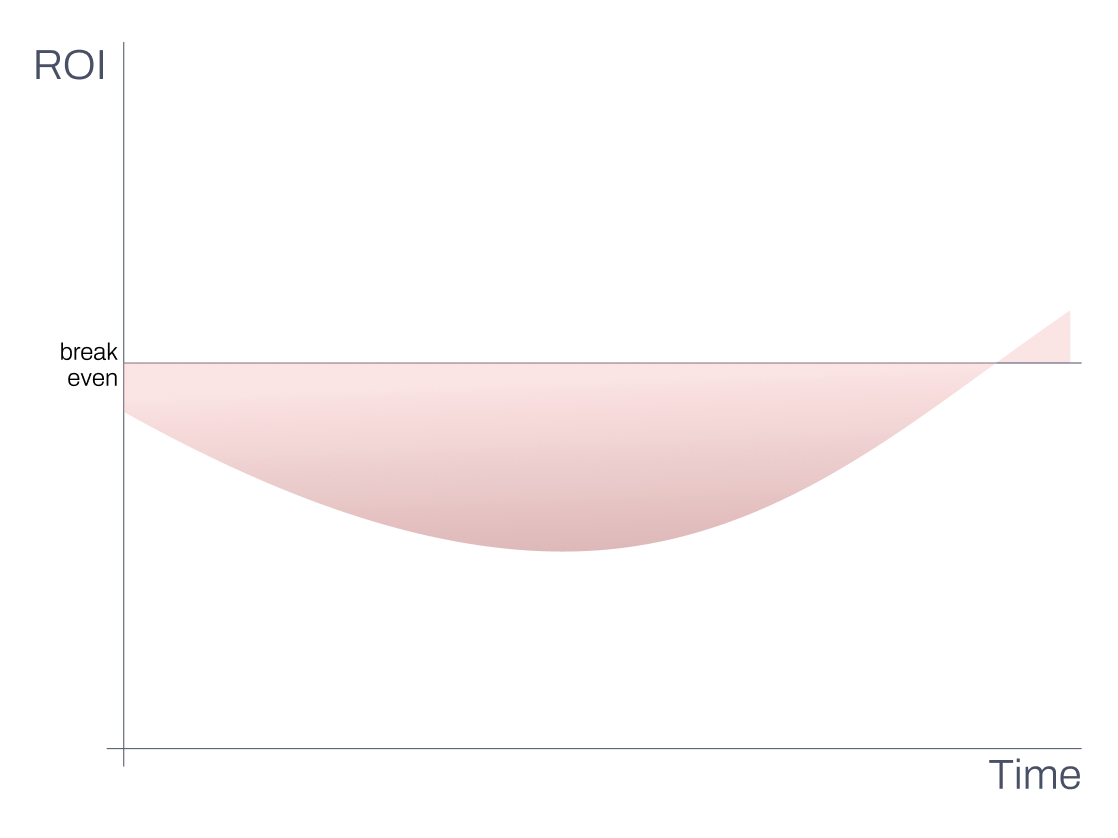

Data Transformation Accrued Return

A complete transformation is typically required before extracting any value.

Data remains siloed, inconsistent, and underutilized. And without a clear activation layer, even institutions that centralize their data often struggle to put it to use. Most of all, these traditional approaches delay ROI for years, if it ever comes at all.

Ascent's Differentiated Approach:

Value First, Transformation by Default

Ascent flips the traditional data model on its head. Instead of asking institutions to clean and centralize data before they see results, Ascent drives transformation as a natural consequence of solving immediate business problems.

Every workflow within Ascent, whether it's new product enrollment, account maintenance, or servicing tasks, is designed to deliver operational value right away. Banks and credit unions automate manual processes, eliminate duplicate data collection, and improve customer or member experiences from day one. But in doing so, they also capture, cleanse, and structure high-value customer/member data at every touchpoint.

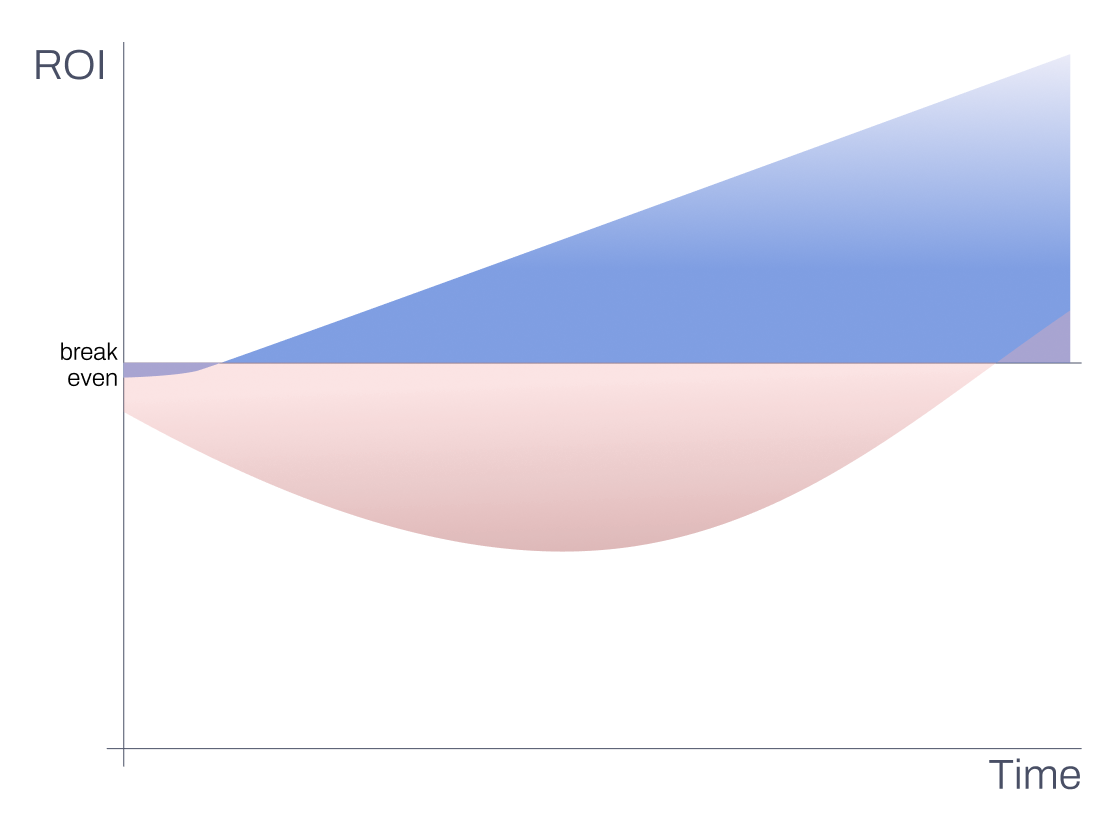

Ascent Accrued Return

With Ascent ROI on your data strategy immediately.

Importantly, Ascent complements, not competes with, ongoing data projects. Many institutions already have data strategies underway, but face hurdles in data quality, usability, or accessibility. Ascent strengthens those efforts by improving data at the source, aligning operational workflows with long-term data goals, and providing real-time access to the insights buried in everyday processes.

Ascent integrates flexibly with existing systems through incremental deployment of solutions for either business or consumer use cases. This removes the need for major infrastructure overhauls or standalone data platforms. Instead of requiring a massive upfront investment, this approach helps institutions build and pay for their data initiative over time; by streamlining processes and automating workflows, Ascent delivers immediate business value while organically acquiring, cleansing, and building rich data profiles across the customer/member base.

Real-Time Intelligence:

Actionable Intelligence from the Ground Up

In addition to the operational and data-building value created by supporting multiple business or consumer use cases, Ascent includes a real-time intelligence layer designed to help financial institutions take immediate, data-driven action across all lines of business. By continuously analyzing live customer data whether for a consumer, a business, or both, Ascent detects life events, identifies risks, and surfaces new opportunities the moment they emerge. This proactive, insight-driven approach empowers institutions to engage customers/members with precision, without waiting for stale reports or fragmented dashboards.

The Long-Term Payoff:

Unlocking OneView and AI-Readiness

Because Ascent transits both business and consumer activity to create a shared data foundation, the entire institution benefits. Organically over time, data quality and coverage improves, feeding Ascent and making it exponentially more powerful. It can detect anomalies, anticipate risks, and present real-time upsell opportunities across both business and consumer portfolios.

Unlike traditional BI tools, Ascent is proactive. It doesn’t wait for queries: it spots problems and opportunities the moment they emerge. And because the data it relies on was collected directly from operational workflows, it's fresher, cleaner, and more trustworthy than anything in a data warehouse, core, or CRM.

The same foundation that powers Ascent also becomes the launchpad for advanced analytics and AI. Institutions don’t need to spend years building an AI-ready environment: they already have one. Ascent makes sure of it.

Conclusion

Ascent delivers what most current data transformation projects cannot: immediate value and long-term intelligence. By deploying Ascent for business, consumer, or both, institutions solve pressing operational problems and simultaneously build a live, centralized view of the customer/member. Combined with its expanding AI capabilities, Ascent positions banks and credit unions not only to catch up, but to leap ahead.

Data transformation doesn’t have to be painful. With Ascent, it happens by design.

July 10, 2025

Download as pdf