Enabling Customer Outcomes: Success from Data and Collaboration

Banks and Credit Unions often fall into the solution-shopping trap, but a new approach relies on defining and measuring outcomes to drive innovation instead of the traditional model of problem-solution acquiring that may not solve underlying issues. In this companion article to episode 7 of Counting Change, Trish North expands on the invaluable discussion of customer success and how leveraging data leads to the outcomes we so desperately seek.

In the evolving landscape of fintech, the concept of customer success has undergone a remarkable transformation. What was once an obscure and undefined role has now emerged as a critical function, driving customer satisfaction, retention, and ultimately, business growth. Here I discuss the evolution of customer success and current best practices for both financial institutions and their fintech partners.

In a Journal of Service Research article on Customer Success Management, author Bryan Hochstein defines it as “the proactive relational engagement of customers to ensure the value potential of product offerings is realized by the customer.” As proof of its significance, LinkedIn ranked "Customer Success Manager" as one of the most promising job roles in 2019. This shift reflects buying organizations' changing needs and expectations and vendors' focus on building long-term, value-driven relationships.

However, customer success as a discipline didn't truly exist until a decade ago. The need for clients to successfully deploy and leverage ever-more complex technology and the imperative for vendors to iterate and grow clients' use of their solutions has led to a natural evolution of vendor/client relationships, allowing for the formal emergence of customer success.

Where We Are Now: Generations of Customer Success

Through my experiences, I've witnessed this metamorphosis which can be traced through Paul Henderson 's outstanding book, The Outcome Generation.

Henderson outlines three generations of customer success:

- The Features Generation: Vendors made products and features to meet their clients' needs and wants.

- The Solution Generation: Vendors sought to meet clients' requirements or solve their problems. They worked with clients to understand specific problems and develop solutions, often investing significant time and resources in the process.

- The Outcome Generation: Rather than focusing on problems, vendors work with clients to define desired outcomes and then work to enable them.

During my career, I've seen financial institutions rely on 'solution shopping' (Solution Generation) numerous times, sometimes without fully understanding or defining the issues they're looking to solve. Even with proper definition, a new solution may lack a champion for helping the client stakeholders understand it, how to use it, and the problems it was intended to solve.

However, using an Outcome Generation approach, the focus shifts away from problem-solution definition to empowering institutions with a deep understanding of the product aligned with desired business outcomes. Additionally, when applied properly, desired outcomes are quantified. An outcome-based approach is necessary for organizational success, especially in today's fast-paced, changing world where a client's problems may be shifting and not easily identifiable. Plus, defining outcomes that can be measured is critical to truly understanding what “success” looks like.

Bumps in the Road: Data Silos and Legacy Systems

In an outcome-driven approach, data plays a pivotal role in understanding whether the institution is achieving the quantified outcomes desired. While access to data is abundant, the challenge lies in its usability and the ability to extract meaningful insights. Data silos and legacy systems are two major roadblocks that prevent the measurement of quantified outcomes.

Data silos keep information compartmentalized within different functions and departments, hindering measurement. And with more tech vendors, more data silos emerge. Many banks and credit unions don't want to put all of their eggs in one basket, so to speak, to avoid reliance on a single vendor or in their desire to acquire best-of-breed capabilities. As a result, data is distilled in different ways, so with each data silo added, it becomes harder to gain a single holistic view of the institution or its end-customers.

Another roadblock to usable data is the presence of legacy systems. These complex systems, built using older technology, make it difficult and costly to access and integrate the data necessary for success measurement.

Fortunately, data access is getting easier as API connectivity-even with legacy systems-has rapidly improved, especially over the past five years. New platforms are emerging that simplify connectivity and management of data across disparate systems and give institutions and their vendors better tools for data access and analysis.

Pulling It Together: Collaboration and Shared Levels of Trust

Collaboration is the third key ingredient for effective customer success management, along with an outcome-based approach and sufficient data for quantitative measurement of results. It may seem obvious that the client and vendor must work together to achieve successful results. After all, it is fundamental that a vendor understands the client's goals, expectations, and challenges.

However, information sharing is not always transparent and bidirectional. The financial institution may feel that its application of the technology is proprietary, and thus, it withholds key elements of its plans and methods. Likewise, vendors may feel that discussing the software's known limitations undermines their position in the relationship or leaves them exposed in some other way.

In practice, the vendor must take the first step here, and work with the client to match that trust and build on it, like ascending a ladder together, if both parties are to achieve their shared goals. The outcome-based approach stresses education and training. Sometimes this requires taking ten steps back to educate and pull everyone forward before continuing to advance. Processes and tools enabling understanding helps vendors and institutions build trust together.

But building trust requires a quid pro quo; unequal levels of trust are not sustainable, and if the vendor cannot convince the client to match them, then trust will be suboptimal and the project will be in jeopardy.

There is another area where collaboration and trust can break down: inside the organization itself. Much like siloed data, if the cultural infrastructure is siloed, the flow of information and informed decision-making will suffer. So for me, running customer success does not mean holding all the answers; I'm not an expert in the product or regulatory team, so it's important to build strong relationships internally so I know who I can reach out to. This is the same inside the buying organization. A lack of trust among stakeholders is death to any customer success effort.

The Destination

More and more, customer success in the fintech industry is moving toward outcome-driven approaches that seek quantifiable results, leverage data to measure those results, and use education and trust to foster collaboration and drive optimal results. The shift from solution-driven to outcome-based customer success reflects the industry's focus on delivering value-driven relationships and long-term success. Data plays a pivotal role in achieving this outcome-driven approach, but challenges such as data silos and legacy systems can and must be overcome using newer systems that connect data across silos. Additionally, collaboration across functions, departments, and organizations is crucial for overcoming challenges, but can only be achieved through shared levels of trust. As the industry continues to evolve, the focus on outcomes, data-driven insights, and collaboration will be instrumental in driving end-customer satisfaction, retention, and growth.

Listen

Listen to Trish North's episode on Spotify, Amazon, or Apple.

About Counting Change Podcast

Arjun Sahgal and Rachel Reid from Ascent Platform host industry experts seeking to drive positive change in credit unions and community finance. Explore the impact of credit unions, community banks, and other financial service providers, discover fintech trends, and understand the role of community finance in building resilient economies. Subscribe for engaging conversations beyond the numbers that will demystify complex topics and inspire you to make a difference. Let's make every cent count together!

About Ascent Platform

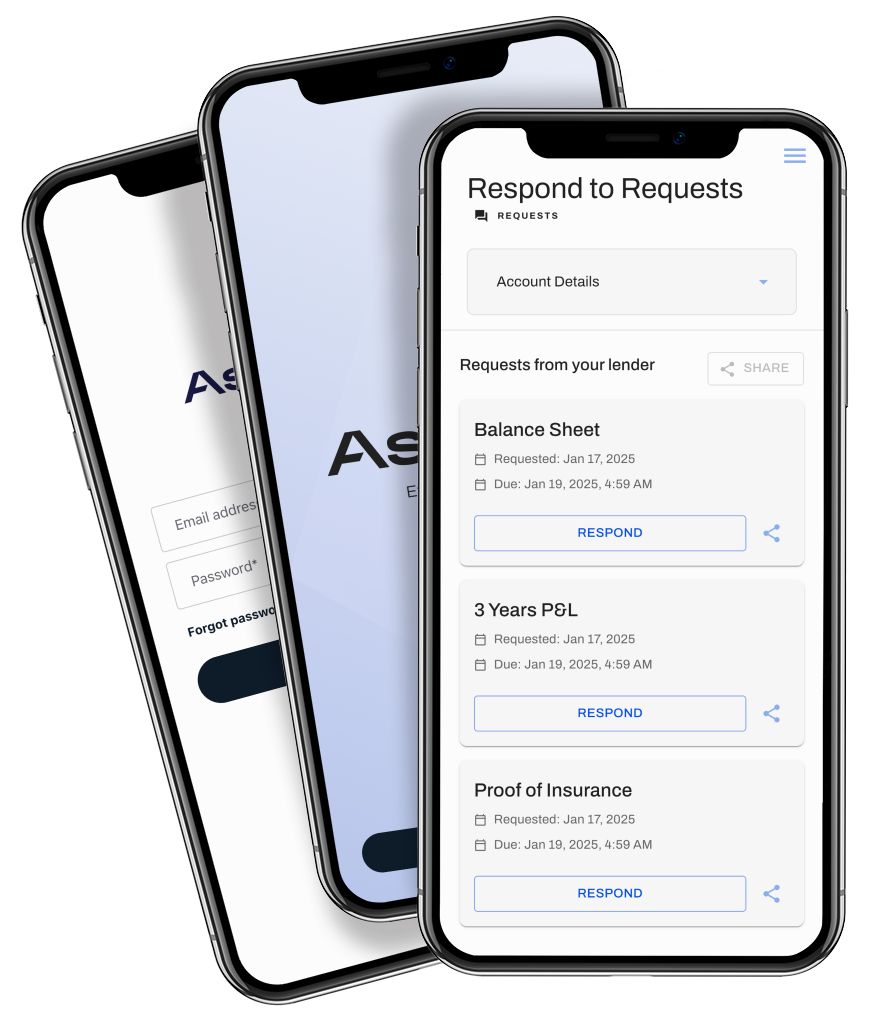

Ascent is the next-generation platform that provides lenders with the ability to streamline any and all product applications and forms without disrupting existing systems and processes. Ascent replaces the patchwork of full-stack product applications, static web forms, and PDFs with intelligent applications and forms featuring prefilled data, optional pre-screening rules and logic, and collaborative document collection. Most importantly, the platform learns from every interaction, and uses those learnings to make subsequent experiences more contextual, with fewer questions for the borrower and less work for the lender. Using Ascent's no-code builder, lenders can rapidly configure and deploy beautiful, bespoke applications and forms at their own pace.

For more information, please visit ascentplatform.io