More data in. More benefits out.

Collect

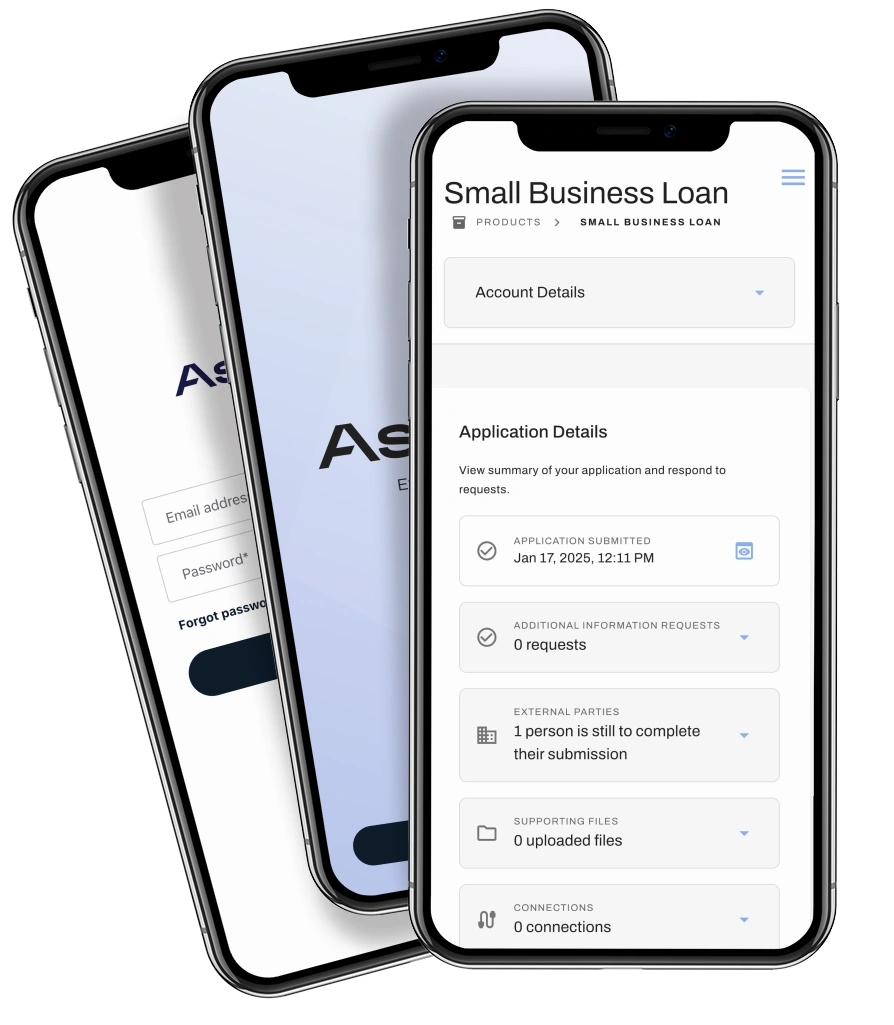

Ascent's industry-leading document and data collection tools make uploading docs, refreshing data and connecting accounts a seamless experience.

60%

more docs collected

at first time of asking using Ascent Data Request Module

Process

Ascent interprets and creates documents, inputs and extracts essential data, runs calculations and presents to your team for action, inside and out of Ascent.

37%

increased accuracy

when collected data verified against Ascent data model

Decision

Automate decisioning with dynamic criteria. Pre-qualify and auto-score confidently, only manually reviewing when absolutely necessary.

65%

decisions automated

and applications auto-routed within Ascent

Monitor

Ascent's data streams and feeds are always on, to ensure your customers are supported and provided opportunities at the right moment for them.

27%

fewer delinquency cases

when using Ascent's Early Warning Module

Start now with any project

Keep doing what you're doing—our platform seamlessly integrates with your existing processes, making deployment effortless. Ascent’s three packages are designed to meet the needs of any size of business.

Module

Reviews and Renewals

Automated Reviews and Renewals replace lengthy manual processes for your team and your borrowers which are full of frustrating back-and-forth, data inconsistencies, and delays.

Suite of Pre-Built Tools

Business in a Box

Suite of business tools and modules - everything you need to work with businesses, reducing underwriting time, and manual workload for you whilst improving understanding of the business.

Fully customizable

Perfectly automated

Need more control? Any of the pre-built components within Ascent can be completely customized. Develop any application, form, or document and power it up with Ascent's data.

The One View that grows with you

Ascent automatically delivers the right data to the right place at the right time, empowering your teams, and enhancing customer experience. Preparing your bank for the future while you focus on the today.

See Everything in One View

All customer data and documents in one place—across every product, application, and review, always up to date and at your fingertips.

Detect Events & Anomalies

Know instantly when life events occur and act fast.

Predict Delinquency

Automated alerts that spot delinquencies before they escalate. Predict issues, take action instantly.

Grow Wallet Share

Unlock growth with ease—confidently identify new product opportunities and pre-qualify customers in one click.

Get answers to big questions

What products and services is this customer getting from other institutions and are we competitive on the rates they're getting?

I got a notification that this customer is near or below debt service coverage. What they can realistically service?

Pre-apply this customer for similar products. Do we need any information from them to complete the applications?

...

Ascent is well positioned to sit on top of the systems we have, automate many of our manual processes, and augment the member experience.

Latest From Ascent

Jun 10, 2025

28 min listen

What Allows for Community Banks to Innovate Quickly

Special Guest: Marianela Vazquez, EVP, Chief Operating Officer Reading Cooperative Bank

Jun 20, 2025

3 min read

Case Study: Members Preferred Credit Union moved from Loanliner.com to Ascent

Josh Johnson, (VP Lending) said that the transition was designed to be invisible to members — and it was...

Jul 09, 2025

Webinar and Live Demo

Webinar: Ascent for TSLA

Live demonstration of how you can level-up your TruStage Loan Application system with a modern, consistent, and easy-to-use platform...